This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Unhedged asked on Wednesday, “Does the order in which similar companies report affect how stocks react to earnings?” Several readers wrote in to say it does. Ben in Chicago pointed us to a paper finding the existence of “contrast effects”. That is, investors think today’s earnings at widget maker X are better if yesterday’s at widget maker Y were terrible. Thus confirming our bias that psychological effects are pervasive in markets. Email us: robert.armstrong and ethan.wu.

Shadowboxing with the term premium

With 10-year yields now at 5 per cent, the rising term premium remains the talk of Wall Street. Here, for example, is Fed chair Jay Powell, in a speech yesterday in New York:

[The increase in long-term yields] is really happening in term premiums, which is the compensation for holding longer-term securities, and not principally a function of the market looking at the [fed funds] rate.

There are many candidate ideas . . . One is that markets are seeing the resilience of the economy to high interest rates and [thinking] even longer term this may require higher rates. There may be a heightened focus on fiscal deficits. QT [quantitative tightening] could be part of it.

Another one you hear very often is the changing correlation between bonds and equities. If we’re going forward into a world of more supply shocks, rather than demand shocks, it could make bonds a less attractive hedge to equities, and therefore you need to be paid more, and therefore the term premium goes up.

We’ve written the term premium to death recently. It refers to the extra compensation investors receive for holding long-dated bonds instead of continuously rolling over short-term bills, in return for taking on duration risk. But annoyingly, the term premium is unobservable, and therefore must be guessed at with fancy maths. It is, by necessity, a bit mysterious. What if the whole thing is an illusion?

In a note published on Wednesday, Ralph Axel of Bank of America makes a stimulating case for ignoring the term premium altogether. He lists several reasons why the term premium isn’t conceptually useful:

Bond buyers who hold to maturity take no duration risk. So in the long run, we should expect a term premium of zero, since a positive premium would represent a “‘free lunch’ for buy-and-hold accounts”.

Many investors cannot freely substitute between rolling short-term bills and buying long-term bonds. For example, a pension investor who needs to match assets with liabilities takes on more risk with bills (hard to match) than with bonds (easy to match). The market is segmented, in other words. Why would one segment get a premium?

Holding long bonds should outperform rolling over short rates when the term premium is high — but don’t. Axel’s chart below shows, in dark blue, the term premium lagged five years and, in light blue, the how much more you’d earn holding a five-year bond over taking the short-term rate. No consistent relationship appears:

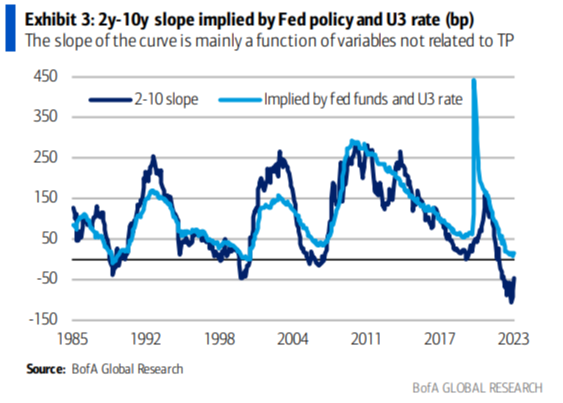

The term premium correlates suspiciously well with the slope of the yield curve. When the yield curve gets steeper (ie, long rates > short rates), term premium estimates rise in lockstep. But which moves which? Axel argues that the yield curve’s shape already has clear drivers: the fed funds rate and unemployment rate (see chart below). So the more plausible case is that term premium estimates are “distorted by curve slope”, meaning that they “are not measuring just a term premium but are mostly reflecting the slope” of the yield curve.

The most convincing explanation for the recent run-up in long rates, Axel argues, is simply markets pricing out recession risk.

Reason 1 above is simply wrong, says Michael Howell of CrossBorder Capital. Many investors who hold bonds to maturity still pledge them as collateral. That opens the door to duration risk, since higher rates diminish the bonds’ value and could prompt a collateral call. He also points to banks, a prominent holder of Treasuries. As Bank of America itself has learned recently, holding low-yielding bonds in a high-rate environment is not without costs.

More broadly, Axel is sceptical of the idea that big US fiscal deficits shifting the Treasury supply-demand balance is behind a higher term premium:

The rise in TP [term premium] since July has been attributed to the rise of fiscal unsustainability fears in the US. We find this argument unconvincing given that the US fiscal path has dramatically worsened since 2008 yet 10y TP is lower by about 300bp since 2008 . . .

In general, the TP has fallen over the years . . . and is currently around the same levels as it was in 2017. This would indicate that inflation risk and fiscal risk are not particularly elevated compared to the outlook 6 years ago.

It is true that the term premium is not particularly high by historical standards. But that doesn’t necessarily suggest fiscal risks are low. It could instead mean the term premium remains too low, relative to the fiscal risks. One has to look at the bigger picture: flat, increasingly price-sensitive Treasury demand combined with rising Treasury supply, all in an inflationary environment. It would be a surprise if that turns out not to matter to long bonds. (Ethan Wu)

Where does the carbon premium come from, if there is one?

ESG investing aims to force changes in corporate behaviour that will promote the common good. If it succeeds, returns from investments that harm our species’ common prospects should rise, all else equal. This seems paradoxical but isn’t. As investors boycott companies that impose costs on society, the stocks and bonds of corporate bad actors fall in value — offering non-boycotting investors the same profits at a lower price. To see why this is a good thing, look at it not from investors’ point of view, but from management’s. For them, the lower stock price means less pay and more expensive capital for use in expansion plans. This is an incentive for change.

That is why those interested in the “E” in “ESG” could welcome the findings of a much-cited 2020 study from Patrick Bolton and Marcin Kacperczyk. It found that companies with higher total emissions levels and greater increases in emissions earned significantly higher returns than other companies, after controlling for other factors. This suggests that investors are demanding a premium for taking on the risks involved with carbon emissions; that the market is putting a price on carbon. Furthermore, the authors find that this is not merely a “sin stock” effect, where disreputable corporations (makers of booze, guns, tobacco) trade at a discount. They find no association between carbon “intensity” (emissions per dollar of sales) and returns — in other words, oil and gas companies are not being singled out while other emitters, who happen not to sell fossil fuels, get away with it. What is happening here is true carbon risk pricing.

But the good news might not be quite so good, however. In a new paper, researchers at Sabanci University in Turkey and the London Business School argue that the carbon premium does not come from heavy emitters’ high cost of capital. Instead, it comes from mispricing: heavy emitters systematically beat earnings expectations, leading to stock price increases. This matters because it suggests markets are not pricing carbon risk after all.

The authors speculate that emitters outperform expectations either because they “do not spend money on reducing their emissions, thus delivering higher earnings than the market anticipated”, or because their high emissions reflect positive shocks — “firms with high levels of and changes in emissions are ones that have received positive demand shocks, and thus generate favourable earnings surprises that investors welcome because they do not believe that high emissions will lead to future costs”. Sales jump, higher production increases emissions, and investors celebrate unequivocally. Either way, they argue, “emissions may be an unpriced externality that harms wider society but not the emitting company . . . these findings highlight the pressing need for government action to address climate change”.

As a sceptic of ESG investing’s impact on the cost of capital, but a climate change believer, I am very sympathetic to the Sabanci/LBS findings. I think ESG investing is a distraction to the important project of regulating and replacing fossil fuels. But there is an important background issue here: the findings of empirical studies of the relationship between ESG scores and investor returns are all over the map. There are dozens of high-quality studies, some finding positive or negative associations, and some finding none at all. The co-author of one major meta-analysis of the literature, Laura Starks of the University of Texas, recently told me the issue was “very much up in the air still”.

It is natural that a new and complex empirical question in finance should take some time to shake out. While that process grinds on, we can only demand that arguments about the effects of ESG investing conform to basic logic and agreed-upon fact.

One good read

“Imagine reading a book about a basketball player exactly as competitive, driven, sadistic and conflicted as Michael Jordan during which it gradually becomes clear that the basketball player cannot dribble with his left hand, and hates playing defence, and also frequently struggles to tie his shoes correctly.”

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Is the term premium rubbish? appeared first on WorldNewsEra.