The Scottish government is planning to sell bonds for the first time, but investors warn that it would face higher borrowing costs than those paid by the UK.

Proposals are still subject to due diligence assessments but the issuance, which is designed to fund “vital infrastructure” including affordable housing, is scheduled before the current parliamentary term concludes in 2026.

The plans to issue Scottish bonds, long nicknamed “kilts”, has been characterised by first minister Humza Yousaf as a way of building credibility in a push for independence.

“This will bring Scotland to the attention of investors across the world . . . And it will raise our profile as a place where investment returns can be made,” Yousaf told attendees at his party’s annual conference on Tuesday in Aberdeen.

Yousaf did not say how much the Scottish government would try to raise, but borrowing limits imposed by Westminster mean it will represent only a tiny fraction of Holyrood’s overall budget.

How much will it cost?

All Scottish government debt is typically underwritten by the Treasury. Assuming the bonds are structured in the same way, investors will not be taking on extra credit risk by buying them.

But they are still likely to demand an interest rate premium relative to the gilt market: the tiny size of Scotland’s bond market would make the debt tougher to buy and sell, and limit its appeal to a small group of investors.

“It’s sensible to assume that there would be some risk premium over a UK gilt, to take account of lower liquidity, a less tried and tested issuer and potentially murkier public finances,” said Nick Chatters, Edinburgh-based portfolio manager at Aegon Asset Management.

Any premium Scotland has to pay will partly be influenced by the credit rating it is assigned by firms such as S&P, Moody’s and Fitch. A good steer are local authorities, which are rated similarly to the UK government but face higher debt servicing costs because of liquidity risk.

Lancashire county council issued £350mn of bonds in March 2020 on the back of an Aa3 rating from Moody’s, one rung below the AA- of the UK government at the time.

Some investors are sceptical as to whether the Scottish government will go ahead, given Yousaf’s announcement comes at a time when borrowing costs have shot up across the world. “I’m not sure how realistic it is in the current context of where rates and yields are at the end of the day,” said Pilar Gomez Bravo, co-chief investment officer for fixed income at MFS Investment Management.

“The Scottish government could do it but I think they would have to pay up quite a lot — more than they think they need to,” she added.

Benchmark UK borrowing costs have risen substantially over the past couple of years as the Bank of England has raised interest rates at the fastest pace in a generation to combat persistently high inflation.

Ten-year gilts yields were 4.7 per cent on October 20, having traded between 0.5 and 2.5 per cent from 2014 to 2019.

Is a default possible?

Most local authorities borrow from the Public Works Loan Board, a part of the Treasury, at a premium to gilts. Occasionally, officials have opted to go to the market directly in search of cheaper loans.

Birmingham city council, the largest local authority in Europe, owed about £470mn to bondholders when it declared bankruptcy in September. This was around 10 per cent of its total liabilities, but the UK government intervened and a default has so far been avoided.

In the US, cities such Detroit have defaulted on municipal bonds. While it is technically possible for that to happen in Britain, so far the UK government’s role as a backstop has prevented this from taking place.

Medhi Fadli, senior vice-president of public finance ratings at Morningstar, said no local authority in Britain had ever defaulted on a bond. “The supervision and support from the central government . . . have been sufficient enough to avoid any default on a bond issuance,” he said.

How much can it borrow?

Under legislation passed in the wake of the 2014 independence referendum, the Scottish government is able to issue bonds as part of wider borrowing powers introduced in 2015.

This decision enabled it to borrow through central government at the same rate as the Treasury via a facility known as the National Loans Fund. Any bond issuance would probably be at a premium and cost the taxpayer more, and be dwarfed by the administration’s £59.8bn in budgeted spending this year.

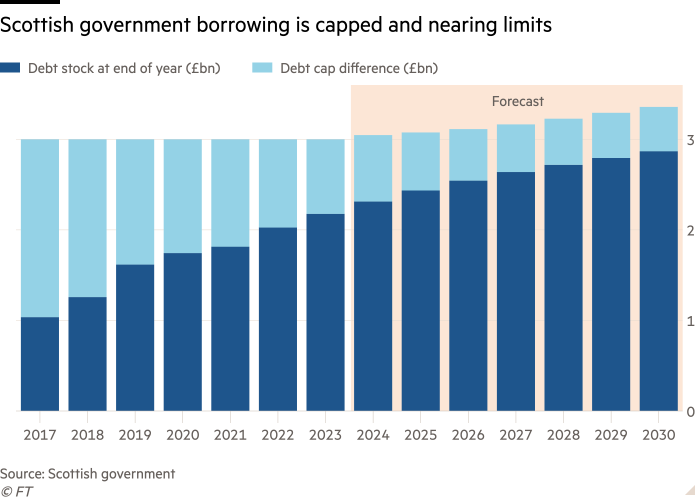

Ministers are restricted to borrowing a capped amount for investment each year. They are currently limited to £450mn in borrowing for the 2023-24 period and can only have £3bn in total debt, though this will rise in line with inflation each year under terms agreed with the Treasury in August.

The Scottish government is already forecast to reach about 80 per cent of its debt cap by 2026, leaving little room for further borrowing via the bond market, according to Mairi Spowage, director of the Fraser of Allander Institute, a think-tank.

That means the importance of any kilt issuance is likely to be largely symbolic, rather than a significant contributor to Holyrood’s finances.

What happens if Scotland gains independence?

While it not certain what would happen to the bonds in the event Scotland gained independence, the Scottish government could include an option allowing investors to return the debt and get their money back.

In such a scenario, Scotland would then issue debt with a credit rating based on its own creditworthiness.

In the lead up to the 2014 independence referendum, rating agency Moody’s said an independent Scotland would be rated between A and Baa, towards the lower end of the investment grade spectrum.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Investors say Scotland would pay a premium on bond sales appeared first on WorldNewsEra.