Trade report of 23-10

The European Central Bank will not raise interest rates again this cycle, but will maintain them at the current level of 4.00% until September next year. By the end of 2024, the interest rate will be reduced to 3.25%. This is what ECB followers say in a survey published by the Bloomberg news agency on Friday.

The ECB Governing Council will meet again next Thursday to discuss interest rates. This time, after ten consecutive steps totaling 4.50 percentage points, further increases will not be on the table. There have been no negative surprises since the previous meeting in the area of economic data on which the central bank bases its decisions. Also, no new economic and inflation forecasts are available at this meeting, which will not appear again until December.

The Italian government of Prime Minister Giorgia Meloni has overcome the first hurdle after loosening the budget reins. On Friday evening, rating agency Standard & Poor’s announced that it would maintain its credit rating at BBB, the second lowest rung of investment grade. The outlook remains neutral. This leaves Italy unscathed. S&P expects that the negative effects of the higher deficit will be offset by higher growth when investments are released from the so-called NGEU fund (almost €200 billion).

Within a month it will become clear whether other credit rating agencies also feel the same way. DBRS will provide a periodic update on October 27, Fitch on November 10 and Moody’s will follow on November 17. Moody’s assessment is particularly exciting. That credit rating agency ranks Italy at the lowest level of investment grade, with a negative outlook. In the event of a reduction, Italian government loans will be given junk status. That is not a good time now that the bond markets are functioning so nervously.

Today’s actions:

EURCHF: rating system gives Score 2 consisting of: Cot Data 3 Retail sentiment -1 Seasonality1 Trend reading -2 GDP Growth 1 Inflation -2 Interest Rates 1 Labor Market 1. We have placed a buy at 0.95.

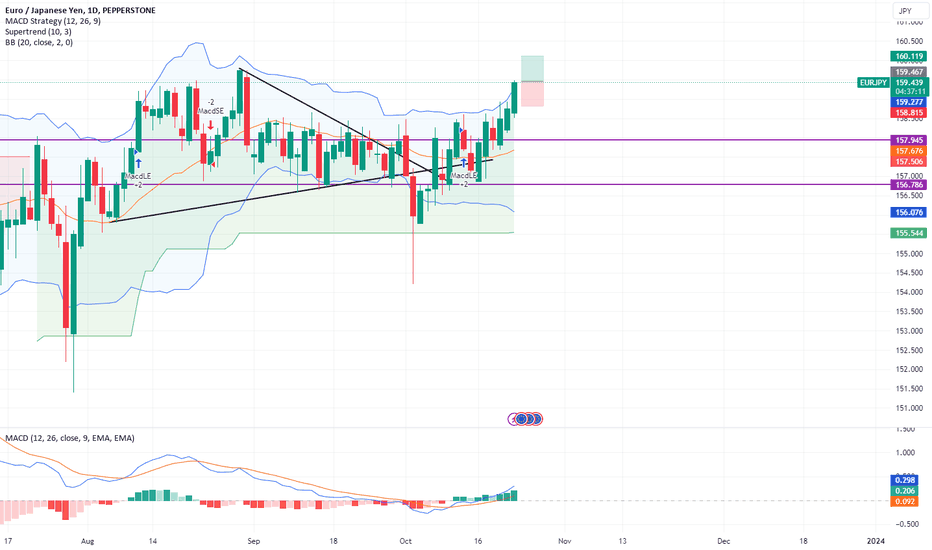

EURJPY : high score in our system 9: Cot Data 3 Retail sentiment 1 Seasonality 1 Trend Reading 2 GDP Growth -1 Inflation 1 Interest Rates 1Labor Market 1. Buy executed at 159,467.

GBPJPY: a Score of +3 which is composed of Cot Data 1 Retail sentiment 1 Seasonality 1 Trend reading 2 GDP Growth -1 Inflation 1 Interest Rates 1 Labor Market -3. Only unemployment in the UK is higher. We executed a buy at 183,240.

GBPNZD : small buy executed at 2,092

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Trade report of 23-10 for PEPPERSTONE:EURJPY by Probeleg appeared first on WorldNewsEra.