[time-brightcove not-tgx=”true”]

China’s millions of Communist Party cadres were warned to stay away from investing in private equity to avoid ownership situations that can breed corruption.

Such investing creates doubts about the integrity of officials and opens the door to the abuse of power for personal gains, an official publisher of the Central Commission for Discipline Inspection said in a recent article.

The practice, which would make them indirect shareholders in firms, is essentially akin to illegally running a business and it should be dealt with accordingly, according to the article.

Read More: China’s Expanded Anti-Espionage Law Threatens Business Consultants and Advisers

Party officials were found to have set up PE funds after they learned of key information of firms seeking to go public, and made “huge gains” after their initial public offerings, it said. Others were found to have provided financing support for firms they indirectly held via their investments. They also became the secretive channels for bribery, according to the article.

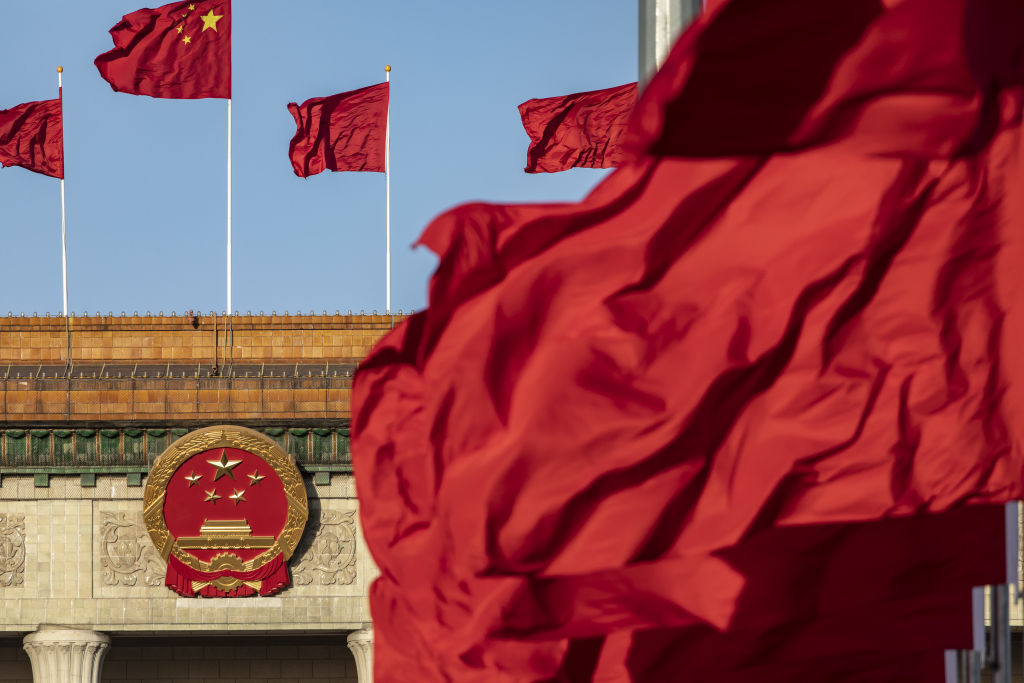

Clamping down on corruption in the sprawling party that controls China has been a signature issue of President Xi Jinping since he took power a decade ago. Over the years it has brought down more than 1.5 million government officials. More recently, the anti-graft body has focused on China’s $61 trillion financial sector in a drive that has brought down more than 100 executives and officials this year alone.

Read More: Disappearance of Ministers Underscores China’s Unpredictability as Xi Tightens Grip

Xi, China’s most powerful leader since Mao Zedong, has been seeking to beef up the party’s long-term governance capacity as well as its “advanced nature and purity.” Last year, he embarked on an unprecedented third term in office and reading of his many volumes of thoughts has become required throughout the corporate sector.

The article, which was widely picked up by local media and circulating among investment professionals recently, is an excerpt taken from a book published earlier this year on the applicability of China’s discipline inspection and supervision laws, according to the post. The book, drafted by CCDI’s case trial department, is aimed at providing authoritative guidance for disciplinary bodies at all levels in their discipline and law enforcement work, it said.

Cadres would still be allowed to invest in private funds that hold publicly traded securities such as stocks and bonds. Typically these have a minimum investments of about 1 million yuan ($136,750).