Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Bank of Japan is now solidly on the path to retiring yield curve control, which is either a disaster or not really a big deal, depending on who you ask.

That move should have implications for US corporate bond markets. Foreign investors — with Japan among the standouts — have been massive yield tourists over the past decade, buying heaps of US credit.

Really!

A quick note about the chart above: it includes both US corporate bonds and corporate asset-backed securities. The latter group almost certainly includes CLOs, which were (are?) favoured by Japanese banks for yield during the negative-interest-rates era.

The foreign-owned corporate bond figure falls to $3.8tn when corporate ABS are excluded. That’s still more than one-third of the US corporate bond market, which weighed in at $10.6tn at the end of October, according to the Securities Industry and Financial Markets Association.

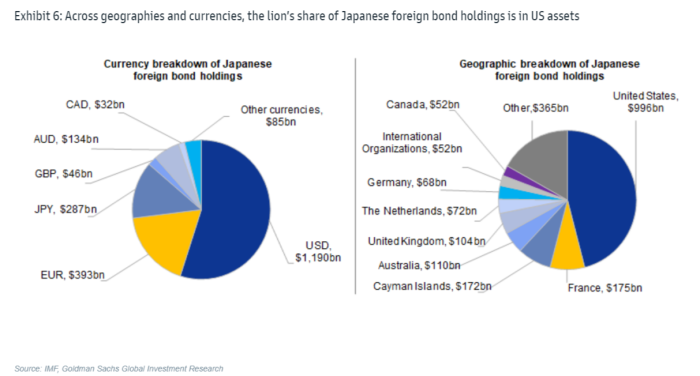

It’s a bit difficult to pin down a reliable figure for Japan’s total US corporate-bond holdings, as Goldman Sachs reckons it is under-reported in the TIC data. But the majority of Japan’s foreign bond portfolio is made up of US-based and/or US-dollar-denominated debt:

So what does it mean if — or perhaps when — global investors get opportunities to earn yield at home, now that yields are allowed to rise? Is the US corporate bond market going to lose one-third of its demand?

If global money does move back to its home markets, it certainly won’t happen quickly. Japanese corporate bond markets are only $826bn, according to ICMA, and Europe’s corporate bond markets are worth roughly $6tn. So finding a destination for nearly $4tn of additional paper would be no small feat.

In Japan, at least, government-bond markets would be the first place investors rotate out their cash, Goldman says.

From the bank:

In our view, irrespective of the pace of normalization of monetary policy in Japan, the depth and especially the breadth of US credit markets and the lack of competing domestic alternatives will likely put a floor on foreign net purchases . . .

Starting with FX-unhedged and unleveraged investors such as pensions and to a lesser extent life insurance companies, an abrupt rotation away from US fixed income instruments into domestic alternatives would likely require a combination of significant strengthening of the JPY, a further re-steepening of the JGB yield curve and material compression of the yield differential with USD bonds.

Collectively, these shifts would cheapen domestic markets (both in absolute and relative terms) while inflicting losses on existing unhedged USD portfolios.

Given the starting levels for both the JPY and the yield differential, the bar is, however, remarkably high. And even so, we think such a rotation will likely manifest itself first in the US Treasury market before corporate bond markets, given the comparable size and depth of the JGB market relative to its US Treasury counterpart.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post What does the end of YCC mean for US credit? appeared first on WorldNewsEra.