Our opinion on the current state of DCP

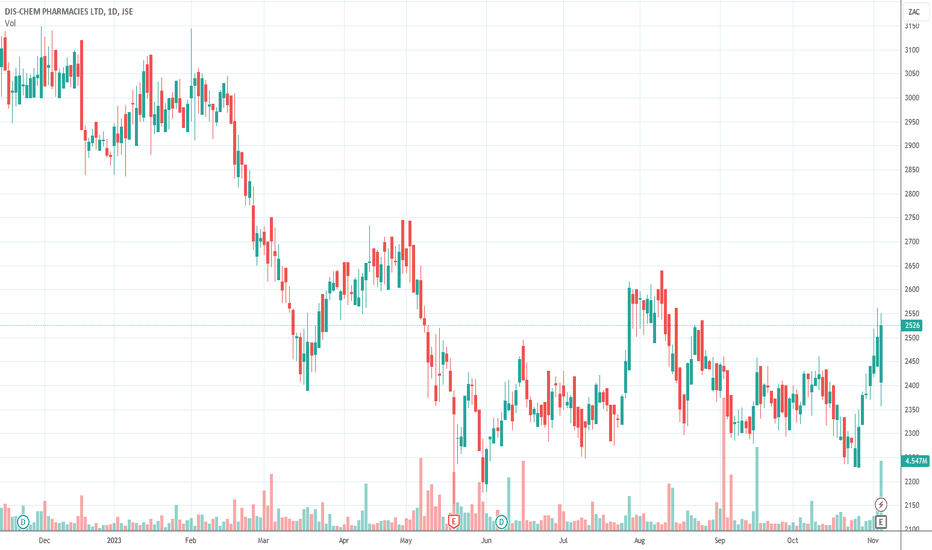

Dis-Chem Pharmacies (DCP) listed in November 2016 and competes directly with Clicks (CLS) in the pharmaceutical, medicine and beauty products markets. It is a family business run by the Saltzman family who had a controlling stake in the business through a private company, Ivlyn. On 24th August 2021 Ivlyn announced the sale of 7,5% of its shares in a bookbuild, 3,75% to selected management (with a 10-year lock-in) and 10,5% to a BEE consortium. This leaves the Saltzman family’s interest at 31.4%. Ivan Saltzman was the CEO, but has resigned and will be replaced by Rui Morais. Dischem’s objective on listing was to expand its store base from 108 stores, which it has now far surpassed. Theoretically, Dischem can have a store in every shopping mall where Clicks has a store. Clicks had about six hundred stores when Dischem was listed and has spoken of plans to expand its store base to as many as 1200. This means that Dischem has considerable “blue sky” potential – which accounts for its relatively high rating (P:E of around 21,67). The company is buying Springbok Pharmacy and Quenets which shows that it is growing rapidly. The company now has more than 254 pharmacies country wide and it is opening between 10 and 20 new stores a year. It may be possible for the company to expand into spaces left in malls as a result of COVID-19. These may be available for lower rentals. The company is benefiting from an increased awareness among customers of the need to boost their immunity and general health by buying more vitamins. On 15th May 2020 Dischem announced that it had acquired 100% of Baby City for R430m in a conditional agreement. There are significant synergies between the two companies’ product and service ranges. The company is expanding into healthcare insurance with the acquisition of 25% of Kaelo Holdings. In its results for the six months to 31st August 2023 the company reported revenue up 9,4% and headline earnings per share (HEPS) down 17,2%. The company said, “The constrained economic environment, higher interest rates and costs associated with load-shedding, has resulted in a weaker performance by the Group over the prior comparative period”. Finance costs were up 33,2% and capital expenditure on tangible and intangible assets of R279m. In our view, this is a solid blue-chip company with a good future. Technically, the share has been moving sideways and downward since making a “double top” in April 2022. We advised waiting for a break up through a 200-day moving average before investigating further. That break appeared to be happening on 3rd November 2023 at a price of 2525c per share. We consider Dischem to be a solid defensive share with good potential.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Our opinion on the current state of DCP for JSE:DCP by PDSnetSA appeared first on WorldNewsEra.