Trade report of 27-11

Today’s actions:

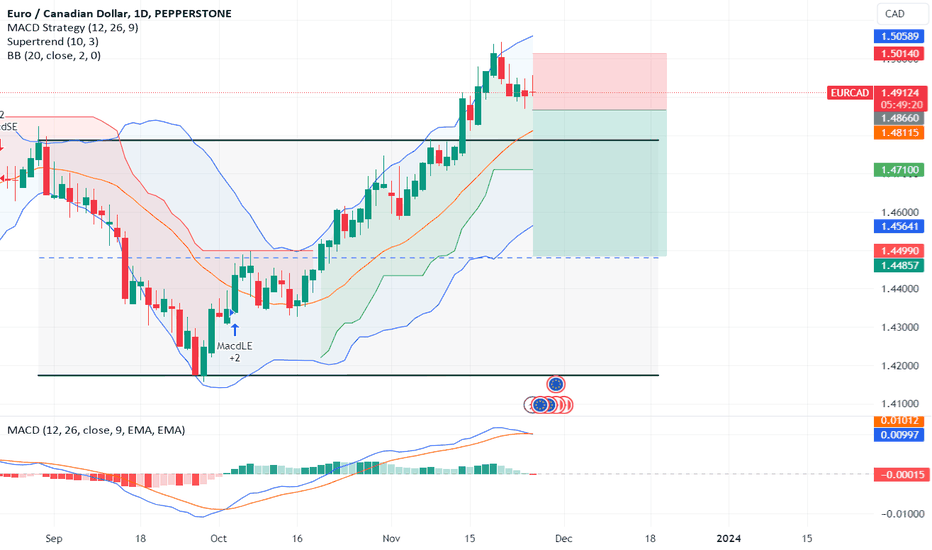

EURCAD: entered a sell range with start of 1.48660 and target 1.44850.

AUDUSD: removed the sell range.

AUDNZD: removed the sell series.

S&P alert enabled.

News:

EURUSD is on the verge of recovering above a key hurdle, but investors will likely need more US data to work with if the broader uptrend is to hold. EURUSD approached resistance at 1.0960/65 on Monday, where the 61.8% Fibo fell from the 1.1276-1.0448 and the day’s high was on August 14, but retreated thanks to a rise in the yield advantage of the dollar against the euro. German 2-year yields (DE2YT=RR) fell faster than inflation figures due later this week, as ECB President Lagarde struck a gloomy tone on economic activity. The fall in German interest rates caused problems for Germany and the US. spreads (US2DE2=RR) to their widest since November 17, helping to depress EURUSD. Yield spreads continue to have a major impact on price movements between the EUR and the USD. Weaker US economic data will be needed to reassure investors that the Fed will end rate hikes and possibly begin cutting rates in May 2024.

GBPUSD hit a new trend high of 1.2644 on Monday as the fall in US Treasury yields reminded the market that growing expectations of Fed rate cuts next year could allow the pound to launch an attack against all-time highs at the end of August against 1.28. In early US trading, cable had retreated from the day’s peak but was still 0.15% higher at 1.2625. The day’s peak was the highest since September 1, with the day’s high at 1.2712 now in focus. Sterling has risen 1.2070 from late October lows on expectations that the Fed’s success in cutting US inflation from 9.1% in June 2022 to the current 3.2% will drive interest rates next year as price growth converges towards the 2% target.

The rise in long-term US Treasury yields has also strengthened the Fed pivot argument, as it is seen as a substitute for further rate hikes.

A slow start to the week, but the USD is weak, with expectations for a month-end currency hedge rebalancing and seasonality not helping.

Shorter-dated options were supported this week ahead of some key data to underline expectations of related currency volatility. The focus was on the fact that the US Federal Reserves favored an inflation gauge in the form of Thursday’s PCE data. The implied one-week volatility is well above the realized one-week volatility, reflecting the increased risk in the future compared to the lack of actual volatility in the previous week.

USDJPY is an exception to the implied versus realized rule and highlights the potential value of long one-week expiration options. Security outflows remain light on Monday, but there is still a clear bias towards USDJPY downside protection.

The one-month USDCNH risk reversals have completely surrendered the recent spike to record highs for CNH calls versus puts, indicating that the spot decline is over for now.

The NZDUSD’s focus is on the major expiration of the 0.6100 strike and close against the nearby 200-day moving average ahead of Wednesday’s Central Bank policy announcement and outlook.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Trade report of 27-11 for PEPPERSTONE:EURCAD by Probeleg appeared first on WorldNewsEra.