Crispr Therapeutics (CRSP) just executed on a moonshot goal as it recently won U.K. approval for the first gene-editing treatment ever. The move sent CRSP stock sky-high, and now the company and partner Vertex Pharmaceuticals (VRTX) are looking to do it again.

X

In November, the U.K.’s Medicines and Healthcare products Regulatory Agency approved Crispr’s drug for patients age 12 and older with blood diseases known as sickle cell disease or beta thalassemia. The Food and Drug Administration plans to make its decision on the drug for treating sickle cell disease on Dec. 8 and as a beta thalassemia medication on March 30.

Chief Executive Sam Kulkarni says the gene-editing technology known as CRISPR — from which the company derived its name — has moved at lightning speed. Just three years ago, researchers Jennifer Doudna and Emmanuelle Charpentier won the Nobel Prize in chemistry, receiving credit for discovering the CRISPR technology in 2011. Now, the technology has won its first approval.

“Here we are within 10 years of elucidation of the technology — from its original discovery — we’re on the cusp of getting something approved,” Kulkarni told Investor’s Business Daily in September. That was before the first approval came two months later.

CRSP stock is now soaring. Shares hit a 15-month high after U.K. regulators signed off on the drug, now known as Casgevy.

CRSP Stock: Molecular ‘Scissors’

Crispr Therapeutics is one of several big-name biotech companies that launched after researchers first discovered the CRISPR technology. The platform uses molecular “scissors” to make cuts in the DNA at specific places. From there, it can add, remove or change the genetic code.

Kulkarni compares it to “molecular surgery.”

“It’s a procedure that we’re offering to them that would potentially help them be cured for life,” he said.

It’s important to note Casgevy is what’s known as an ex vivo gene-editing drug. That means the actual genetic editing is applied to the patient’s cells outside the body, via the drug, rather than inside the patient. Companies also are working on in vivo gene editing, where the edits take place inside a patient’s body. This could also give CRSP stock a fresh chance to shine.

Casgevy works to help the body make correct forms of hemoglobin, a key protein involved in carrying oxygen in the blood. Sickle cell patients experience malformed hemoglobin. Beta thalassemia patients don’t make enough beta globin, one of the building blocks of hemoglobin.

Caveats To ‘Historic’ Approval

The U.K. approval is contingent upon further testing. Crispr must apply for re-approval each year. But test results so far have been promising. Sickle cell patients have reported fewer vaso-occlusive crises, painful episodes that can land them in the hospital. Beta thalassemia patients don’t need as many, or any, of the blood transfusions that previously kept them alive.

“For patients suffering from sickle cell disease, for instance, we’ve been waiting a very long time for a drug that has a meaningful impact on these patients,” Kulkarni said, noting doctors have known for about seven decades that sickle cell disease is genetic. “What this medicine has shown is that you can have a potentially curative medicine you can bring to these patients.”

Crispr has yet to set a price tag for Casgevy, but it could be in the millions of dollars range. That has, so far, been the case for gene therapies that only need one treatment.

RBC Capital Markets analyst Luca Issi acknowledged the U.K. approval is “historic.” But he notes patients must first undergo a conditioning regimen. That drug, dubbed busulfan, wipes out the patient’s bone marrow to prep for the gene-editing treatment. Doctors also use busulfan before bone marrow transplants.

But busulfan can lead to infertility and carry other side effects.

Limited Distribution

Issi also notes only certain centers can administer these gene-editing drugs, making uptake difficult for far-flung patients.

“We remain cautious given therapy will likely be initially restricted to severe patients, infrastructure may not be in place, patients can lose fertility and oocyte/sperm cryopreservation is an out-of-pocket cost in many states, and we fundamentally believe that the chronic (treatment) model is unlikely to be disrupted until novel preconditioning becomes a reality,” he said in a note to clients.

He has a sector perform rating and price target of 50 on CRSP stock.

But other analysts are more bullish. The pool of patients in the U.K. is relatively small at about 2,000 eligible patients.

“While the approval comes in line with our expectations, the approval remains a historic milestone for gene editing as a whole as this technology enters the commercial arena in earnest,” Leerink Partners Mani Foroohar said in a recent note.

He has an outperform rating on CRSP stock.

What’s Next For CRSP Stock?

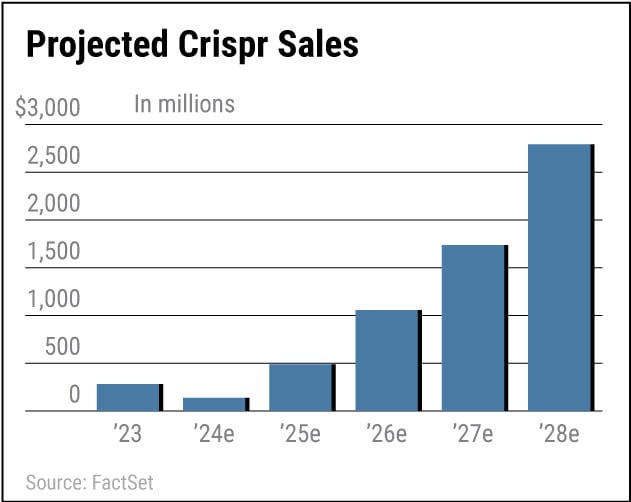

Analysts are also watching for what’s next from Crispr Therapeutics.

The company is testing two in vivo gene-editing approaches for atherosclerotic cardiovascular disease, also known as ASCVD. In this heart disease, plaque builds up in the arterial walls.

ASCVD increases the risk of heart attacks, angina or hardening of the vessel walls known as stenosis. One Phase 1 study has already begun. Mizuho Securities analyst Salim Syed expects the second to follow in early 2024.

Further, Crispr is testing immuno-oncology treatments, including drugs for forms of lymphoma, kidney cancer and solid tumors. Kulkarni, the company’s CEO, says these next-generation drugs will be 10 times more powerful than their predecessors.

He also notes the company is working on gene-editing treatments for diabetes.

Strong Relative Strength Rating

Leading up to the FDA’s potential approval for a sickle cell treatment, investors are taking notice.

The stock has a strong Relative Strength Rating of 95, putting it in the top 5% of all stocks when it comes to 12-month performance, according to IBD Digital. Last year, CRSP stock had an RS Rating of 38.

Shares also just broke out of a cup base with a buy point at 72, MarketSmith.com shows. Crispr stock fell as much as 6.2% below its entry on Nov. 21, but that wasn’t enough to trigger a sell rule. Investors should cut their losses when a stock drops 7% to 8% below its entry.

Kulkarni says this is just the beginning for Crispr.

“We have a platform that’s very scalable and expandable, and I foresee in five years we may have 20 to 30 different programs in the clinic,” he said.

Follow Allison Gatlin on X, the platform formerly known as Twitter, at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Olema Stock Has Soared 551% This Year. Its CEO Thinks It’s Still Undervalued.

Here’s Why Medtronic’s Financial Turnaround Is Starting To Look Tangible

Stock Market Today: Track Market Trends And The Best Stocks To Watch

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

Checkout latest world news below links :

World News || Latest News || U.S. News

The post What’s Next For Crispr After Its ‘Historic’ Gene-Editing Approval? appeared first on WorldNewsEra.