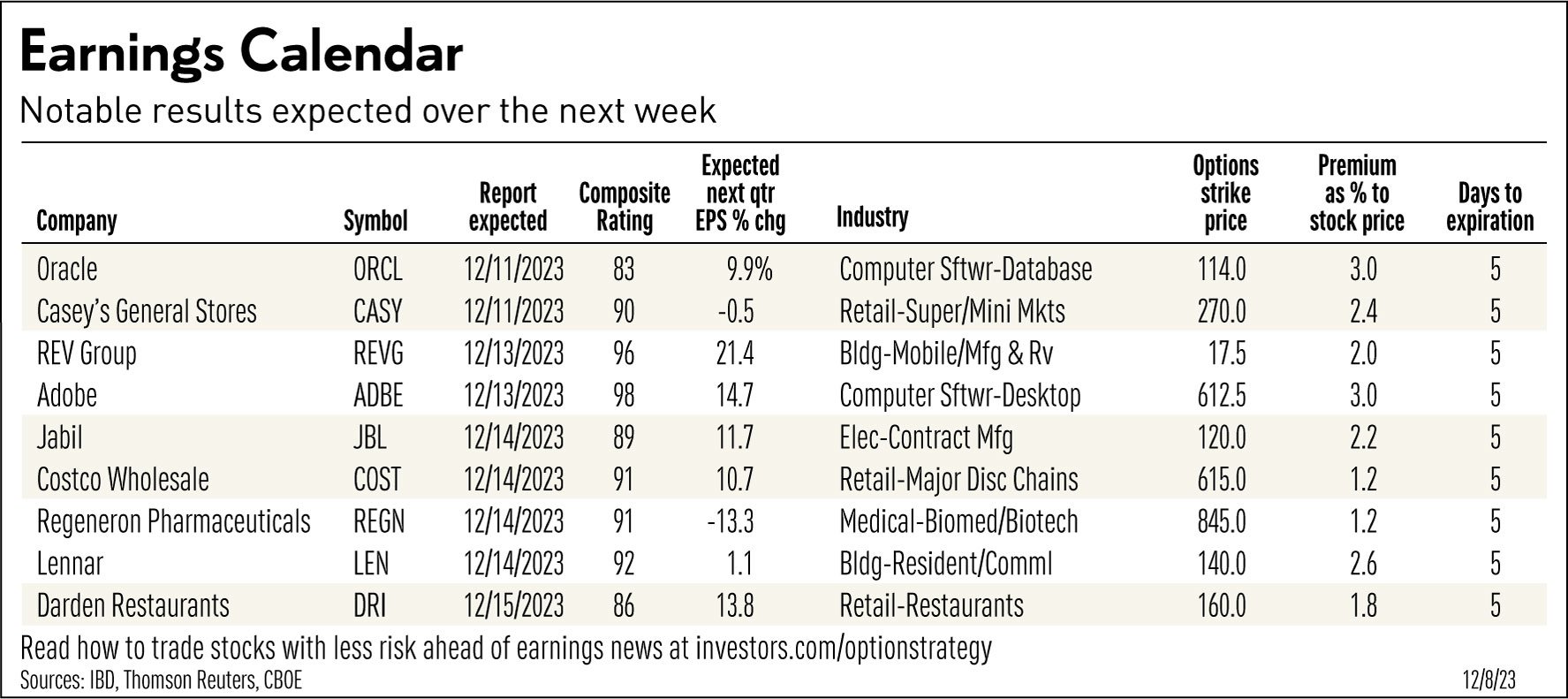

A slimmed-down earnings calendar has plenty of noteworthy reports to consider in the coming week. In the technology sector, all eyes will be on reports from Oracle (ORCL) and Adobe (ADBE). Retailer leader Costco (COST) is also on the earnings docket along with homebuilder Lennar (LEN).

X

Costco stock hasn’t looked back after a buy signal on Nov. 10 when shares jumped 2.5% in higher volume. The stock continues to hold near highs amid expectations for another strong quarter.

The stock reversed higher on Sept. 27 after the company reported revenue growth that accelerated from the prior quarter, up 9% to $78.9 billion. That was $1 billion above estimates from Refinitiv at the time for $77.9 billion.

Costco ended the quarter with 71 million paid household members, up nearly 8% year over year.

Analysts polled by Zacks Investment Research expect Costco to report adjusted profit of $3.44 a share, up 11% year over year. Revenue is seen rising 6% to $57.6 billion. Results are due Thursday after the close.

Earnings Calendar Spotlight

Oracle is first up on the earnings calendar, with results for the November-ended quarter due Monday after the close.

Analysts predict profit of $1.32 a share, up 9%, with revenue up 6% to $13.05 billion.

ORCL stock is back above its 50-day moving average but still more than 10% off its high.

ORCL gapped below its 50-day line in September after the company reported a 16% rise in quarterly profit. Revenue increased 9% to $12.5 billion. The results were mostly in line with expectations but company forecasts were soft.

In June 2022, Oracle closed its $28.2 billion acquisition of Cerner, an electronic health record software firm. But Chief Executive Safra Catz acknowledged that the acquisition is weighing on results as Oracle transitions Cerner to the cloud, slowing down its revenue growth.

Watching ADBE

Adobe, meanwhile, reports Wednesday after the close. Earlier this year, the company unveiled its Adobe Firefly, a generative machine learning model that’s now part of Adobe Creative Cloud.

Adobe gapped down to its 50-day line in mid-September despite reporting earnings growth that accelerated for the second straight quarter. Adjusted profit rose 20% to $4.09 a share, with revenue up 10% to $4.98 billion.

Revenue at the company’s Digital Media segment came in at $3.59 billion, up 11%. Digital Experience revenue totaled $1.23 billion, up 10%.

See Which Stocks Are In The Leaderboard Model Portfolio

“We are unleashing a new era of AI-enhanced creativity around the world with innovations across our product portfolio,” Adobe CEO Shantanu Narayen said in the September earnings release . “The recent launches of Firefly, Express, Creative Cloud and GenStudio make Adobe magic available to millions of users.”

Last month, U.K. regulators said the company’s proposed $20 billion buy of Figma could harm competition in the nation’s digital design sector. Adobe first announced plans to buy Figma in September 2022. The Figma platform allows users to collaborate on app and website design.

Earnings Watch: Jabil, Darden, Lennar

Outside of the software sector, contract manufacturer Jabil (JBL) reports Thursday before the open.

JBL stock gapped below its 50-day line in late November after the company gave downbeat revenue guidance. It now sees fiscal first-quarter revenue of $8.3 billion to $8.4 billion, at the low end of its prior forecast of $8.4 billion to $9 billion.

In the restaurant group, results from Darden Restaurants (DRI) are due early Friday. The parent company of Olive Garden is sitting in a buy zone after clearing a cup-with-handle base with a 158.70 buy point.

On the heels of a strong earnings report from fellow homebuilder Toll Brothers (TOL), Lennar (LEN) reports Thursday after the close.

LEN stock is near the top of the 5% buy zone after clearing a cup-with-handle base in light volume on Dec. 1.

Options Trading Strategy

A basic options trading strategy around earnings — using call options — allows you to buy a stock at a predetermined price without taking a lot of risk. Here’s how the option trading strategy works and what a call option trade recently looked like for Adobe, one of the more prominent names in the latest earnings calendar.

Join IBD experts as they analyze leading stocks in the current stock market rally on IBD Live

First, identify top-rated stocks with a bullish chart. Some might be setting up in sound early-stage bases. Others already might have broken out and are getting support at their 10-week lines for the first time. And a few might be trading tightly near highs and refusing to give up much ground. Avoid extended stocks that are too far past proper entry points.

A call option is a bullish bet on a stock. Put options are bearish bets. One call option contract gives the holder the right to buy 100 shares of a stock at a specified price, known as the strike price.

Check Strike Prices

Once you’ve identified an earnings setup for a call option, check strike prices with your online trading platform, or at cboe.com. Make sure the option is liquid, with a relatively tight spread between the bid and ask.

Look for a strike price just above the underlying stock price — that’s out of the money — and check the premium. Ideally, the premium should not exceed 4% of the underlying stock price at the time. In some cases, an in-the-money strike price is OK as long as the premium isn’t too expensive.

Choose an expiration date that fits your risk objective. But keep in mind that time is money in the options market. Near-term expiration dates will have cheaper premiums than those further out. Buying time in the options market comes at a higher cost.

Earnings Calendar Option Trade

Adobe is a fairly liquid name in the options trading market.

When ADBE stock traded around 602.50, a slightly out-of-the-money weekly call option with a 605 strike price and a Dec. 15 expiration came with a premium of around $21 per contract. That was 3.5% of the underlying stock price at the time.

One contract gave the holder the right to buy 100 shares of ADBE stock at 605 per share. The most that could be lost was $2,100 — the amount paid for the 100-share contract. To break even, the stock would need to rise to 623.50, factoring in the premium paid.

Keep in mind this is not a trade for a smaller portfolio because buying 100 shares of Adobe in this trade would cost $60,500.

Follow Ken Shreve on X/Twitter @IBD_KShreve for more stock market analysis and insight.

YOU MAY ALSO LIKE:

Best Growth Stocks To Buy And Watch

Catch The Next Big Winning Stock With MarketSmith

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Software Giants Adobe, Oracle Headline Earnings Calendar; Costco, Lennar Also Set To Report appeared first on WorldNewsEra.