Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Ryanair is close to hitting share price and profit targets that would trigger a €100mn bonus for its CEO, the FT reports. If that happens, it will be one of the biggest payouts in European corporate history (nine-digit annual pay is somewhat more common in the US). Whenever I see those kinds of numbers thrown around, I wonder about the incentives of CEOs who become dynastically wealthy. Once a boss has many hundreds of millions, rather than just tens of millions, how does this change their risk appetite? Their ability to see themselves and others in proper perspective? I have never seen anything written about this. I’d be curious to hear your thoughts: robert.armstrong.

Higher for longer is dead; long live higher for longer

From an article in the FT entitled “Investors ditch notion that interest rates will stay ‘higher for longer’”:

“Higher for longer is dead,” said Kristina Hooper, chief global markets strategist at Invesco. “Powell wrote the epitaph [this week].”

As recently as early November, markets had been bracing for an extended period of elevated borrowing costs as central banks continued their battle to tame inflation.

In recent weeks, signs of a cooling economy and softer price growth data had helped to ease those concerns — lifting bond and stock markets. But the Fed’s closely watched “dot plot” projections on Wednesday were seen by many as the most official sign yet that “higher for longer” was over.

We have noted more than once in this space that rate-peak triumphalism carries its own risks. The view that the Fed will cut rates four times or more next year, and growth will remain positive, has become a crowded trade (over at the WSJ, James Mackintosh has written a nice account of just how crowded). But, even assuming that the consensus view of Fed policy and near-term growth are on track, this is a good moment to remember that the debate about the trajectory of rates was only ever partly about inflation and the central bank. It was also about whether the 40-year bull market in rates that began in 1981 is coming to an end for reasons that have nothing to do with the shocks of the pandemic — reasons ranging from the demographic (change in the balance of savers and investors), to the fiscal (widening deficits), and the geopolitical (deglobalisation). We have written about this question here, here, and here.

While we have seen 10-year Treasury yields fall by about a percentage point from their October highs, they remain 150 basis points higher than the averages during the post-GFC, pre-pandemic era. And remember, long rates’ recent rise was never convincingly explained by tiger Fed policy; longer-term inflation expectations, however measured, have always remained under control.

If long rates revert to pre-GFC levels and real rates remain positive, the implications for fiscal policy and asset valuations will be significant. That’s the “higher-for-longer” scenario long-term investors should be thinking about, and it’s about more than just the Fed.

The strange case of covered call ETFs

Last week we wrote about how equity volatility is strangely low relative to rates volatility. One explanation several experts offered us was the popularity of “yield enhancement strategies,” specifically the sale of covered calls. This is a longstanding income strategy in which investors sell call options against stocks they own. The idea is that while the stocks will get “called away” if their prices rise past the options’ strike prices, the premium earned by selling the options provides income and some downside protection should stock prices fall.

The widespread selling of calls for income depresses the options’ prices, and with them option-based measures of implied equity volatility such as the Vix index.

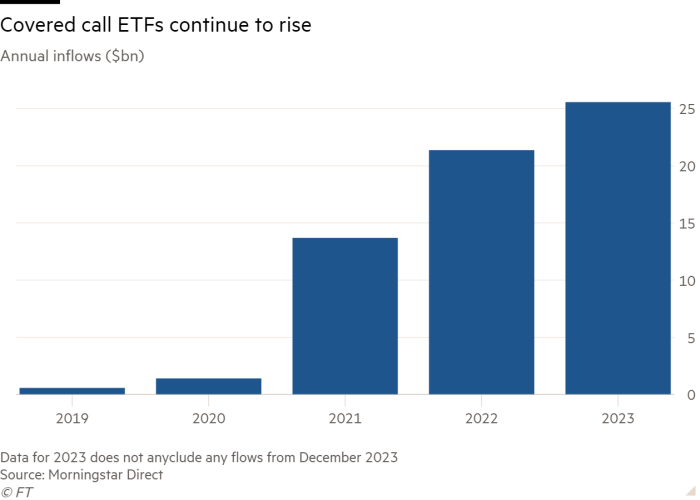

Also last week, our colleague Will Schmitt wrote a good piece about the surging popularity of covered call ETFs, which are actively managed products that provide easy, tax-efficient, liquid access to the strategy. The funds attracted $26bn in assets this year, bringing the total to $59bn.

It is not surprising that the strategy performed well in 2022, when stocks were falling. When stocks decline, call premiums amount to free money. And because covered call strategies tend to focus on stocks with high dividend yields, covered call funds may have been underweight the big tech stocks, which underperformed that year. And it is natural that the outperformance attracted investor flows.

What is surprising, even weird, is that the flows continued in 2023, when rising stock prices meant call options were coming into the money, creating a performance drag in covered call funds, and at the same time rising real bond yields were creating attractive alternative sources of income. Here is a total return (that is, dividend-inclusive) chart of the S&P 500 and the JPMorgan Equity Premium Income, the largest of the covered call ETFs (current yield 9 per cent):

Covered call strategies, over a long time period, are likely to underperform buy-and-hold strategies, even as they outperform in down markets. In up markets, stocks that are “called away” in a covered call portfolio have to be bought back, creating costly churn. The strategy only makes sense for investors who put a premium on current income, or those who think markets are likely to move broadly sideways. So why should the strategy become even more popular in a year when other income opportunities are proliferating and stocks are rising?

Perhaps this is just evidence that strategies have momentum — they can take on a life of their own, whatever the fundamentals are. And perhaps an increasing number of investors want income strategies that do not come with the interest rate risk that comes with bonds.

I asked one of our favourite equity options experts, Nitin Saksena of Bank of America, about this. He’s a bit puzzled too:

There’s been a lot of head scratching around the growing popularity of yield enhancement/income strategies. If volatility is nothing more than a risky form of yield, why sell options for yield when money market yields are as high as they are?

The best answer we hear is that there is simply an insatiable thirst for yield today, and many of these strategies are intentionally offering uncommonly high dividend yields on the order of 10 per cent or more. We’re even aware of examples where a strategy with lower returns but higher dividend income is more popular than a similar strategy with higher total returns but lower yield.

This is reminiscent of a pattern we also observed in business development companies: investors who care more about absolute yields than total returns. It looks like a market inefficiency, though whether it is an exploitable one is unclear.

One good read

James Bennet on illiberalism at the New York Times.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Higher for longer lives on appeared first on WorldNewsEra.