Nothing changes sentiment like price, as the old Wall Street saying goes.

A rally off the October lows has the S&P 500 index

SPX

trading just 1% away from its record close of 4796.56 set on Jan. 2, 2022, while the Dow Jones Industrial Average

DJIA

has pushed into record territory this month.

Meanwhile, Bank of America’s latest survey finds sentiment among global fund managers the strongest since January 2022, as seen in the chart below.

BofA Global Research

That marks a nice rise off the low scored earlier this year around the collapse of Silicon Valley Bank, but leaves the gauge at 3.4, up from 2.5 in November, still toward the bearish end of the 10-point scale.

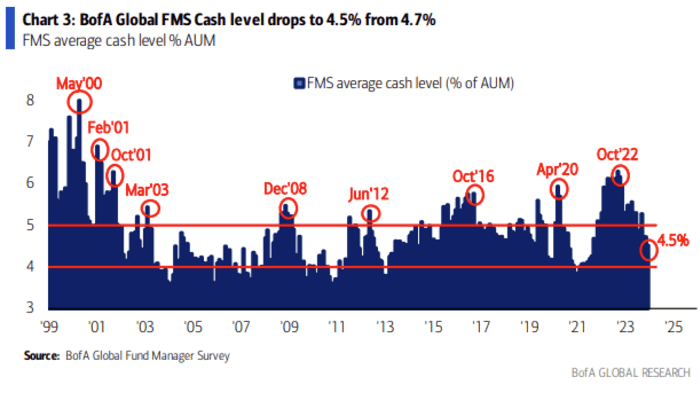

Cash levels — a component of BofA’s sentiment measure — dropped to 4.5%, a two-year low, from 4.7% in November and 5.3% in October. That marked the largest two-month drop since February (see chart below).

BofA Global Research

The optimism comes down to expectations for a “Goldilocks ’24” scenario in the new year, wrote analysts led by Michael Hartnett, in a Tuesday note, with “policy, not positioning, the new tactical driver of asset prices.”

When it comes to the Federal Reserve, 91% of managers said interest rate hikes are over, while 89% expect rates to fall. Bonds and technology stocks are seen as the biggest winners as the Fed cuts rates in the first half of 2024.

BofA’s Bull & Bear Indicator, a contrarian gauge, remained at 4.5 in December, the analysts said, a “neutral” reading.

The survey found a net 50% of investors expected weaker global growth, but more than 70% were looking for a “soft” or “no landing” economic scenario, while optimism on earnings per share was the highest since February 2022.

What could rain on the parade? The biggest “tail risk” is a “hard landing” for the economy, according to 32% of investors, BofA said, followed by high inflation that forces central banks to keep interest rates elevated (27%), while 17% cited the potential for increased geopolitical turmoil.

The survey compiled responses from 254 panelists between Dec. 8 and 14 with $691 billion in assets under management, BofA said, with 219 participants with $611 billion in AUM responding to global questions and 140 participants with $310 billion in AUM responding to regional questions.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Fund managers most upbeat on stock market since January 2022 as S&P 500 nears record appeared first on WorldNewsEra.