Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Callie Cox is US investment analyst at eToro.

This year might’ve been a good one for the stock market. Yet it may have been a disaster for your portfolio.

We’re just a few days from the end of 2023, and 72 per cent of S&P 500 stocks are underperforming the index year-to-date — the most since at least 2000, according to the data. Even worse, one-third of S&P 500 stocks are down on the year, despite the 24 per cent rally we’ve seen in the broader market.

© Bloomberg, eToro

Take a classic approach to market analysis and you’d have a good argument for calling this a bull market. However, as we’ve figured out in 2023, recessions — and bull markets — are in the eye of the beholder.

If you’re the average investor who tosses a set amount of money into index funds on a regular basis, you likely don’t care which names make up a rally. You just want higher prices, and you got them this year. In fact, if you doubled down on popular retail names — think the Magnificent Seven — your investments could have doubled this year.

But if you’re somebody who makes a living off of big, bold calls and stockpicking then you probably have some explaining to do. Yes, even with the S&P 500 within 1 per cent of a record high.

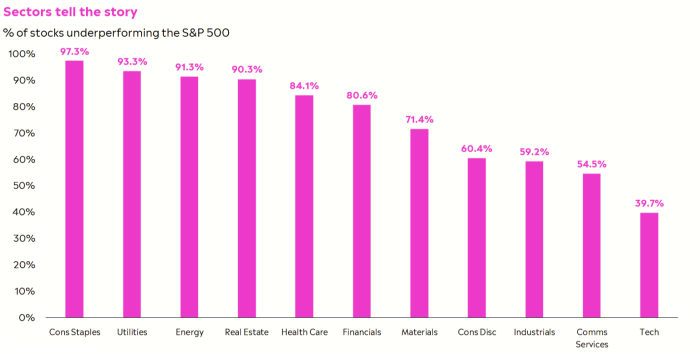

You can chalk this uneven market to one main culprit: high rates. There’s less money floating around in the system, and people are being more selective about where they put it. Look at sector performance and you’ll see what I mean. More than 90 per cent of consumer staples, utilities, and real estate stocks are lagging the S&P 500 this year.

© Bloomberg, eToro

Known for their dividends, these sectors have been hammered by attractive yields on bonds and cash. Plus, this year was dominated by industry-specific stories — bank meltdowns, commercial real estate fears and oil volatility.

No matter how your portfolio has done, though, it’s important to consider how this weird year has changed the perception of markets. Markets could be dealing with a similar phenomenon as the economy — a “vibecession”, where your mileage may vary depending on what pockets of the market you’re watching.

This may be a good thing, too. It’s hard to get too euphoric about the future when a large swath of the market is suffering. After all, bull markets are fuelled by healthy scepticism.

It’s hard to paint this market with a broad brush, and it hasn’t been a bull for everybody. Still, you may not be able to afford sitting this one out entirely. And if you’re sitting next to Uncle Bob the value manager at Christmas dinner, don’t ask him about the fund.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post One weird-looking bull market appeared first on WorldNewsEra.