Weekend trade report

This week: It will start in the spring. Sometime in the second quarter of this new year, the European Central Bank (ECB) will cut official interest rates for the first time since September 2019. That is at least the expectation of the majority of the 48 international economists who published the Financial Times just before New Year’s Day asked. This group includes economists who think that the first interest rate cut will even come in the first quarter. Inflation is falling faster than expected and the ECB may have stepped on the brakes a little too hard in 2023, the consensus is. High time for a series of interest rate cuts. By the end of 2025, the central bank’s deposit rate could fall below 2.25%. Now it stands at 4%.

This scenario is already well priced in on the capital markets. Interest rates fell across the board at the end of last year. To many people’s surprise, 2023 turned out to be an excellent year for shares and bonds.

If all forecasters are right, the high interest rates of 2023 were therefore a temporary phenomenon. Post-corona stress and the energy crisis caused inflation to flare up, central banks responded a little late and therefore had to apply the brakes extra hard. But then it was dust

Some analyses:

Gold fell last week after the ADP NFP numbers came in higher than expected. While more jobs can be good for the economy, this is generally a bearish sign for the metal, which typically struggles with US growth. However, ADP news is not very accurate. Gold could fall further to test support on an ascending trendline in the 1D timeframe.

NAS100

Stocks continue to fall on the day after unemployment and ADP news. So far this year, markets have fallen from the March 2022 highs after reaching them in late December. Recent doubts about the Fed’s possible rate cut in March also appear to be taking their toll. The support is around $16,169.

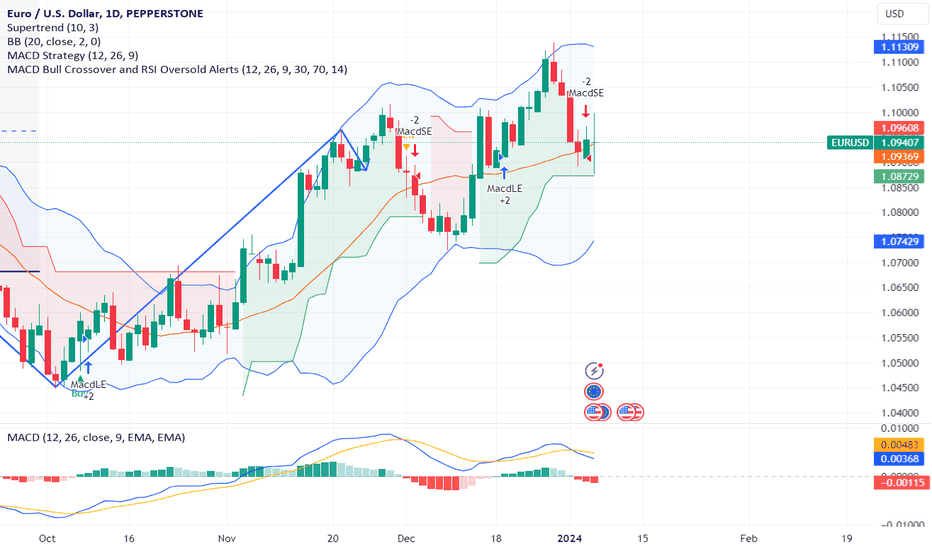

EURUSD

The EU is supported by an upward trend line in the first D-frame as the dollar strengthened at the start of the year. The US NFP will have a big impact on the price action on this pair as it looks like a higher number could be bearish. But if the NFP comes in lower than expected, the pair could find some room to recover from this level of support.

We will start taking new positions again in the coming week.

These are the moments to pay attention to in the coming week:

Mon Jan 8

CHF CPI m/m

Tue Jan 9

Wed Jan 10

AUD CPI y/y

GBP BOE Gov Bailey Speaks

Thu Jan 11

USD Core CPI m/m

USD CPI m/m

USD CPI y/y

USD Unemployment Claims

Fri Jan 12

CNY CPI y/y

GBP GDP m/m

USD Core PPI m/m

USD PPI m/m

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Weekend trade report for PEPPERSTONE:EURUSD by Probeleg appeared first on WorldNewsEra.