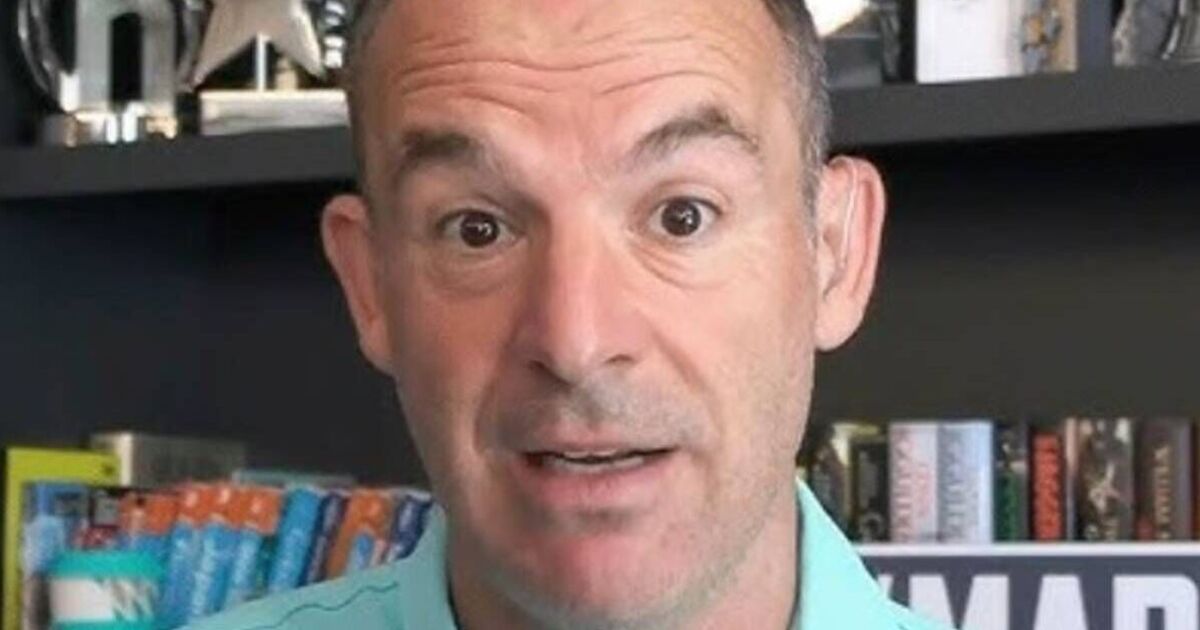

Martin Lewis, the renowned financial guru from BBC Sounds and ITV, has made an impassioned plea for individuals to reassess their banking choices amidst fluctuating easy-access rates across the UK.

Taking to social media platform Twitter, Lewis advised his followers: “The top easy access savings now beat fixes. Check what yours pay, you can still get 5% or more.”

In his much-anticipated weekly newsletter, he elaborated: “What’s happening to savings is a mirror of mortgages, except here higher rates are good, lower bad. The rate you can fix at has dropped, as they’re based on longer-term interest-rate predictions, while the top paying variable (easy-access) rates haven’t, as they’re based on the UK base rate, which the Bank of England held last week.”

“So while normally you tend to get better rewarded for locking money away in a fix, right now you don’t. The market consensus is the UK base rate will be cut in November, so easy-access rates are likely to drop 0.25 percentage points then, but that’d still leave the best of them on par with current fixes, so it’s looking good, especially if you want access to your cash,” reports Birmingham Live.

“Though the benefit of fixing is long-term rate surety, so if you want to ensure a certain rate, and not risk big future drops, fixing and fixing longer does that (and as fixed rates may creep down a touch over the coming months, sooner is likely safer).”

Martin Lewis, the financial guru behind MoneySavingExpert.com, has highlighted a crucial tip for savers: “For everyone though, the key rule is there are HUGE variances between the best and the bog-standard rates in each category, so check what you earn, and ditch and switch if you can.”

The MSE guide points out that the top performers are Chip with 5%, Oxbury at 4.87%, OakNorth Bank offering 4.82%, and Monument at 4.81%. Chip allows savers to start with no minimum via an app, whereas Oxbury requires a minimum of £25,000 online, capping at £500k. OakNorth Bank sets its minimum at £20k, and Monument starts at £25k.

Lewis emphasises the breadth of choice for savvy savers: “There are far more options in top savings, including top big-name savings, plus higher rates if you have (or open) the right current account,” he advises.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Martin Lewis urges everyone with a bank account to switch to ‘four’ banks appeared first on WorldNewsEra.