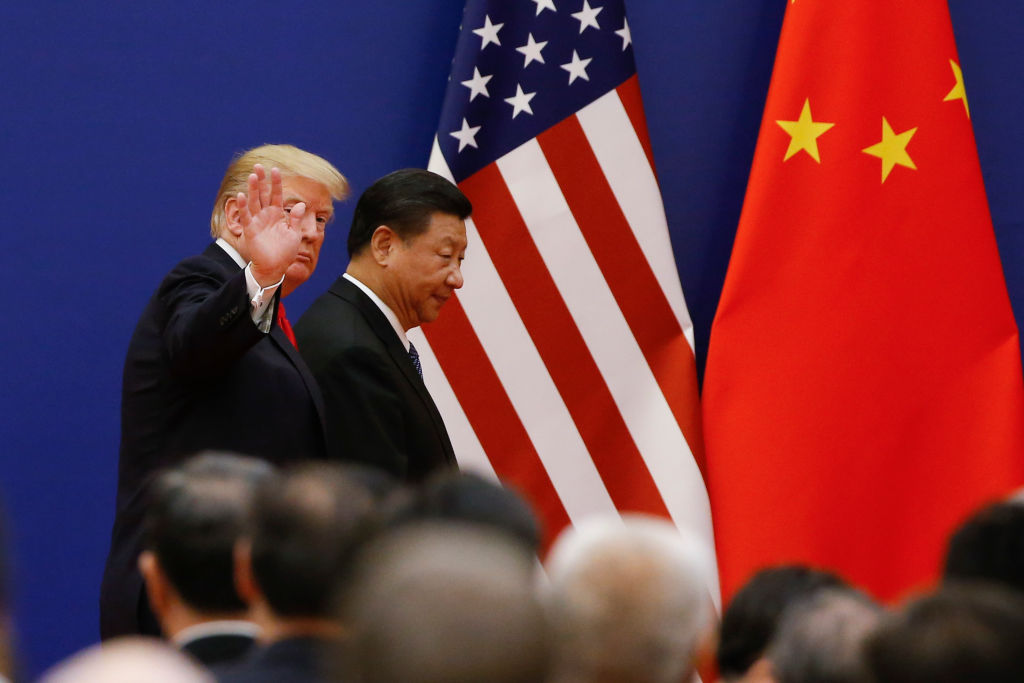

It was with a red carpet jig that Donald Trump touched down in the Malaysian capital on Sunday morning to be greeted by Prime Minister Anwar Ibrahim ahead of the 47th ASEAN Summit. But the question remains whether the U.S. President will still be in dancing mood upon the culmination of his six-day Asian tour and especially after Thursday’s pivotal meeting with his Chinese counterpart, Xi Jinping.

[time-brightcove not-tgx=”true”]

Simmering trade tensions between the superpowers boiled over earlier this month with Beijing ramping up export restrictions on rare earth minerals and permanent magnets—materials vital for myriad industrial processes—prompting Washington to hike tariffs on Chinese exports to 130% from Nov. 1.

In Kuala Lumpur, U.S. Treasury Secretary Scott Bessent said a “framework” agreement for the leaders to “consummate” has been reached for a tariff truce, including a revival of Chinese purchases of American soybeans, a year-long pause on rare earth restrictions, as well as a “final deal” on the sale of social media platform TikTok in the U.S.

In turn, China’s top trade negotiator, Li Chenggang, said the two sides reached a “preliminary consensus” that must now be ratified by each side’s internal approval processes. Certainly, China desperately needs some reprieve from the tariffs as it battles myriad economic challenges, including slowing growth, entrenched deflation, record youth unemployment, and a depressed real estate sector.

“We know China-U.S. relations cannot go back to the past, but we need stability, a soft landing, for the Chinese economy, American economy, and also for the world economy,” says Wang Yiwei, director of the Institute of International Affairs at Renmin University in Beijing.

Still, while much of the world holds out hope that its top two economies with $45 trillion combined output can thrash out a meaningful deal, there is no guarantee. “Bessent’s comments … suggest leaders Xi and Trump will have no formal U.S.-PRC trade agreement to announce on Thursday in Korea,” says Sean King, senior vice president focusing on Asia for consulting firm Park Strategies. “Rather, it seems the two sides have merely come up with yet another framework that just enables them to keep talking.”

Reasons for pessimism are clear. Time and again, Trump has ripped up negotiations on a whim—most recently ending trade talks and hiking import levies on Canada by 10% in response to an anti-tariff ad published by the government of Ontario.

Trump argued that the ad intends to “interfere” with an impending decision on the legality of his tariffs by the U.S. Supreme Court, which is due to hear oral arguments on Nov. 5. Indeed, Wang believes that looming decision may back Trump into a corner in South Korea by strong-arming him into an accommodation lest his tariff leverage be suddenly excised. “This game does not work for the U.S.,” says Wang. “American consumers, markets have suffered. China and the U.S. need relations back to a normal, stable relationship.”

Then again, even if Trump does sign up to a truce, there’s no saying how long it will last—especially if the Supreme Court comes down on his side. According to Forbes, Trump flipflopped 28 times on proposed tariffs from his April 2 “Liberation Day” announcement through July 14—and there have been many more since, as evidenced by the slew of TACO—or Trump Always Chickens Out—memes that have proliferated on social media.

Sticking to a deal “doesn’t seem to be Trump’s game,” says Chong Ja Ian, professor of international relations at the National University of Singapore. “Not just on the trade front, but what he’s doing domestically in the United States—his whole point is disruption and keeping opponents off balance and on the back foot.”

Even with staunch allies. In early September, the Japanese government agreed to reduce auto tariffs from 27.5% to 15% in exchange for a $550 billion investment commitment in the U.S. However, the White House subsequently insisted that the investment deal must first be “clarified”—how much is directed where and when—with Trump reserving the right to impose new levies if he doesn’t like the result. Trump travels to Tokyo on Monday to meet new Japanese PM Sanae Takaichi, and sorting out this confusion will no doubt be at the top of her agenda.

Given this new era of perpetual negotiation, even if a deal is reached between Trump and Xi on Thursday, it’s unlikely to provide lasting relief—and especially as Washington and Beijing are anything but allies. The U.S. squeezing China on access to advanced chips and China’s return limits on rare earths have galvanized each side to address their respective strategic weakness. In May last year, China established a $47.5 billion state fund to boost its semiconductor industry; the U.S., meanwhile, has inked billions of dollars worth of rare earth deals in recent months with nations including Saudi Arabia, Australia, and, just on Sunday, Malaysia.

It speaks to a confrontational dynamic between the U.S. and China that renders interdependence a weakness, self-reliance the new lodestar, and Great Power collaboration largely a thing of the past. Adds Chong: “Given this increasingly competitive orientation, and also the PRC willingness to hit back, I’m afraid that predictability and certainty isn’t going to be forthcoming anytime soon.”