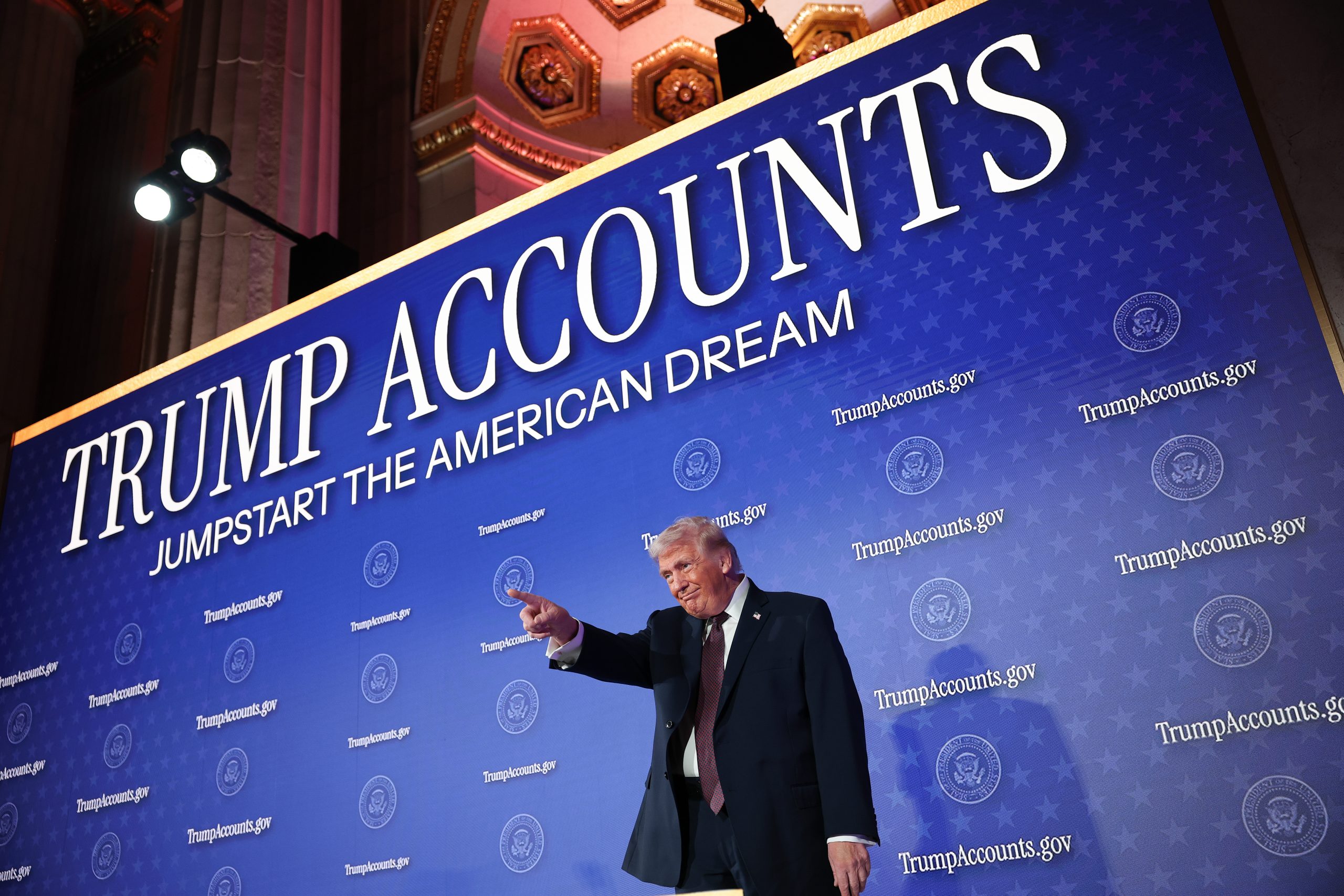

President Donald Trump touted his “Trump Accounts” at a U.S. Treasury event on Wednesday, during which he celebrated giving “every newborn American child a financial stake in the future.”

“We’ll fund those personal accounts with a seed contribution of $1,000 which will compound and grow over the course of their lives,” the President informed the crowd, who were greeted by a sign that read “Trump Accounts jumpstart the American dream.”

[time-brightcove not-tgx=”true”]

Detailing how the initiative is set to work, Trump said that parents and contributors, such as other relatives and employers, can add up to $5,000 annually to a child’s account. He claimed that, with “modest contributions,” the value of each pot should reach a total of at least $50,000 by the time the child turns 18.

The President paid tribute to tech billionaires Michael and Susan Dell, celebrating the pair for donating $6.25 billion towards the project.

“We also expect to have commitments from generous private individuals in all 50 states, and they’ll be making additional contributions for children in their own states,” said Trump. He thanked billionaire investor Ray Dalio for pledging to donate $250 per child for approximately 300,000 children under the age of 10 in Connecticut.

Among the recognizable names present for the launch event were Republican Sen. Ted Cruz of Texas, businessman Kevin O’Leary, and rapper Nikki Minaj, who referred to herself as the President’s “number one fan.”

Trump praised his “Big Beautiful Bill” that was signed into law on Independence Day last year, stating the baby accounts initiative wouldn’t have happened were it not for the bill instigating, what he claims are, “the largest tax cuts in American history.” (According to the Tax Foundation think tank, the Trump Administration’s bill is only the 9th largest tax cut in the U.S. since 1940.)

While the White House is heralding the accounts as a sign of success—Trump referred to it on Wednesday as “one of the most transformative policy innovations of all time”— some experts have raised concerns.

In an article for TIME in December, Stanford economists Neale Mahoney and Adam Shaw argued that Trump Accounts will disproportionately benefit well-off Americans. “The program may be open to every child, but its benefits will flow overwhelmingly to families with the means to contribute thousands of dollars a year,” they noted.

With American families curious as to how they might benefit from Trump Accounts, here’s what you need to know.

What is a Trump Account?

The initiative was first suggested by a House GOP group last year ahead of the introduction of the One Big Beautiful Bill, signed into law in July. The bill, called the “Money Accounts for Growth and Advancement Act,” also known as the MAGA Act, proposed a $1,000 tax-free benefit to qualifying American children.

The “Trump Accounts” proposal was refined in June, following a meeting the President shared with top business leaders, lawmakers, and investment CEOs.

Every Trump Account will launch with a one-time $1,000 government seed contribution.

Claiming that these “tax deferred investment accounts” will “chart the path to prosperity for a generation of American kids,” the White House has centered the initiative as a key component on its approach to affordability amid the ongoing cost-of-living crisis.

Does your baby qualify for a $1000 Trump Account and what do you need to do?

According to the Trump Accounts website, the $1,000 bonus will be given to each baby born between Jan. 1, 2025 and Dec. 28, 2028, falling within Trump’s second presidential term.

The account will be listed in the child’s name, with parents acting as the sole custodian until the child is 18.

Parents are currently able to enrol their child when they file a newly-created IRS Form 4547. Following enrolment, “a financial institution will receive your funds and activate your account.”

Accounts will be open for further contributions upon the official launch of the initiative on July 5.

Should parents contribute the maximum $5,000 annually on top of the baseline $1,000, each jumpstart fund is estimated to be valued at $303,800 by the time the child turns 18, based on historical averages of the S&P 500 index.

Funds will be invested into “a diversified portfolio of low-cost index funds designed to maximize long-term growth while minimizing risk.”

These funds can then be accessed, without penalty, for “qualified expenses” such as education, buying a first home, or starting a business.

However, some withdrawals may be subject to restrictions and would be taxed at ordinary income rates. The Trump Administration has yet to expand upon these restrictions, but parents can sign up to receive further updates via the official website.

Are older children eligible for payments?

Children born before 2025 won’t be eligible for the $1,000 newborn bonus, but parents can still set up accounts for children under 18 years of age, so long as they have a valid Social Security number.

Through the contribution of the Dell couple, the first 25 million American children aged 10 and under, living in ZIP codes with median incomes below $150,000, will receive an additional $250, according to the White House.

Dalio, founder of asset management firm Bridgewater Associates, also committed to contributing an additional $250 per child for around 300,000 children in Connecticut.

“The funds are initially targeted for children under 10 who live in a Connecticut zip code where the median income is less than $150,000,” Dalio’s philanthropy firm said in December.

Furthermore, on Wednesday, Trump announced that investor Brad Gerstner had pledged to provide $250 for each child under five with a Trump Account in Indiana. According to the First Five Years Fund, as of late 2025, there are around 494k children aged 5 and under in the state.

“This President is voracious in his desire to hear from America’s leaders about how to make America better. This is citizen democracy at its best,” said Gerstner at the launch event.