Today, that backdrop has changed. US Treasury yields recently climbed to their highest level since October 2007, and a wider global bond rout has put fixed income back in vogue.

Nevertheless, with inflation sticky, interest rates likely to stay higher for longer, and recession threatening to suppress those bond yields, alternatives – and real assets in particular – remain an attractive and important opportunity for investors of all sizes.

Nuveen’s Harry Bush: The vehicles driving investors towards private markets and what they mean

Once the preserve of large institutional capital allocators, real assets are becoming more accessible through a nascent but growing range of daily dealing funds coming to market.

So, let us take a closer look at ‘liquid real assets’ and the opportunities for retail investors looking to implement them as part of a robust and diversified portfolio.

Real assets universe

We define real asset strategies as those that invest in the equity of one or a combination of infrastructure, real estate and nature-based assets, and we approximate the total real assets fund universe to be over $4.5trn in aggregate.

Real estate still accounts for the largest portion of the illiquid, liquid and total aggregated universe and is the asset class most familiar to a broad range of investors.

However, we are spending more time researching infrastructure and nature-based solutions (NBS) universes, spurred on by a number of attractive characteristics within these strategies, including: positive carbon impact – infrastructure and nature-based solutions can help investors meet their carbon emissions or net zero targets as well as investing directly in decarbonising or carbon sequestering assets.

Global alternatives industry poised for slower growth as macro headwinds bite

Also, inflation protection. These strategies are thought to be high relative performers in environments of high and increasing inflation.

Finally, they can provide a rapid pace of growth. Both the liquid and illiquid universes of infrastructure and nature-based have seen strong medium-term growth; notably, the illiquid infrastructure market has increased over 120% over the past five years.

Liquid vs illiquid markets

If you are able to lock up your capital for 12 plus years, then private-market, illiquid strategies may provide additional premiums, less volatile performance, and access to unique and ‘under-the-radar’ deals and markets.

However, not all investors can or want to invest in funds with long-term lock-up periods, for example due to regulatory or liquidity constraints in their portfolios.

CFA Institute launches private markets and alternatives programme

Daily dealing funds are significantly more liquid than their private market counterparts and can also provide different benefits – notably:

· Liquid funds can be monitored and compared more easily through a broadly accepted benchmark. Data is also more widely available and reported on.

· Listed companies have more stringent reporting requirements, usually meaning that there is a high level of transparency when investing in liquid markets.

· The listed company universe (excluding investment trusts) is complete and defined, predominately by industry benchmarks. This therefore limits the requirement for additional sourcing and origination resource.

Liquid infrastructure and liquid NBS

The liquid infrastructure and liquid nature-based solutions universes are made up predominately of investment trusts (investing directly in unlisted companies or properties) and pooled funds (investing in public markets).

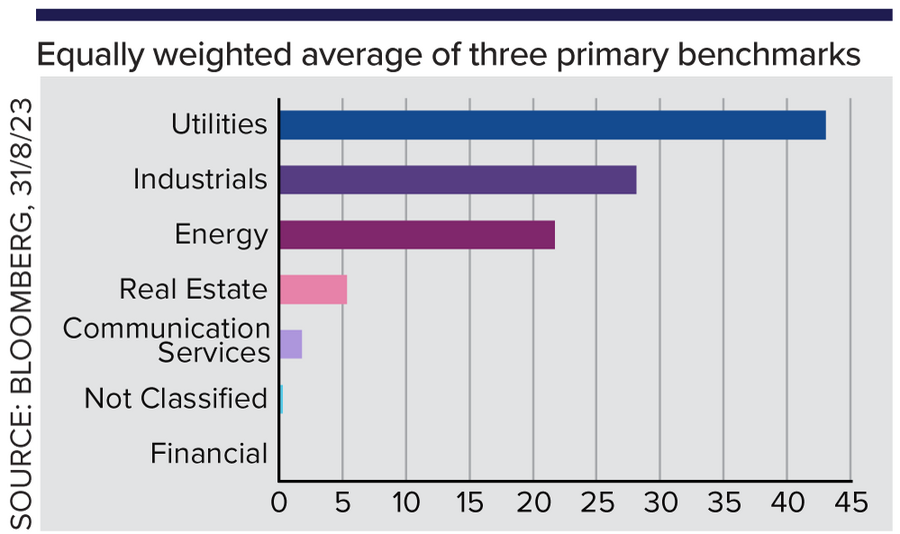

Looking at the three most popular indices (S&P, FTSE and Dow Jones Brookfield), we can see that the listed infrastructure universe is predominately focused in the US and across Utilities, Industrials and Energy.

Meanwhile, the materials sector dominates the underlying holdings of the S&P Global Timber & Forestry index and the S&P Commodity Producers Agribusiness index.

Our own liquid nature-based fund universe is still relatively small, with fewer than 50 strategies, but the market is growing and no longer beyond consideration for retail investors.

Key considerations for investors

For those looking to implement liquid Infrastructure or nature-based funds in their portfolios, here are some important characteristics to consider when selecting a manager:

· Breadth and expertise of investment teams: infrastructure and nature-based assets require particular expertise to underwrite, manage and own.

· Correlation with existing public market holdings: some of these strategies have high correlations to broader equity market funds.

· Portfolio concentration: the asset universe is smaller than in other public markets, meaning portfolios may hold fewer positions.

· Exposure to Policy Risk: the underlying revenues of portfolio companies may be more dependent on government policy in these asset classes, e.g. energy price caps or biodiversity subsidy regimes.

Infrastructure and nature-based funds tend to have clear impact or sustainability objectives, potentially making them all the more compelling for investors with their own responsible investment ambitions.

For now, the implementation options in public markets do remain limited compared with other asset classes, but as daily dealing real assets funds become more commonplace, these opportunities – and the above considerations – will soon become more prominent features in the retail investment landscape.

Sarah Miller is senior vice president in Redington’s manager research team

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Redington’s Sarah Miller: How retail investors can approach Real Assets implementation appeared first on WorldNewsEra.