Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. The US economy continues to surprise: the latest example was new housing starts of 1.6mn in November, an almost 15 per cent jump from the month before and well more than economists had projected. But is the market pricing in even more than the strong economy (and the Federal Reserve) can plausibly deliver? More on that below. Email me your thoughts: robert.armstrong.

Exuberance revisited

It was only two weeks ago that this column suggested that markets might be getting a bit giddy. Rising surveys of investor bullishness; increasing market breadth; outperformance by small caps and cyclical stocks; furious rallies in highly speculative assets — all these suggested that spirits were running high, perhaps getting ahead of economic or corporate fundamentals. If so, small disappointments could lead to a big repricing of risk assets. But we concluded that all the exuberant phenomena were short lived and should not be over-interpreted: “This hasn’t gone on long enough to convince us that we are seeing irrational exuberance.”

Now that an unexpectedly dovish Fed meeting has poured gasoline on the flames, might that placid judgment need revisiting? To focus on just one of the indicators we looked at earlier, small cap US stocks — as represented by the Russell 2000 index — have risen 8 per cent just since last week’s Fed meeting, against 2.5 half per cent for the big-cap S&P 500. Given the Russell’s reputation as a home for companies with low profitability and leveraged balance sheets, that looks like a big increase in risk appetite. And small caps are not alone: my colleague Robin Wigglesworth describes what we are seeing as a “Bad Santa rally”: unprofitable tech stocks, heavily shorted companies, highly leveraged companies and Spacs (Spacs!) are all screaming higher.

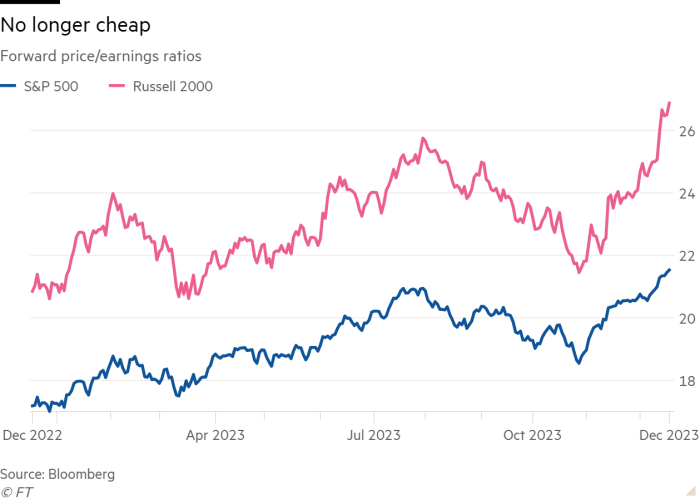

Valuations, as a result, are starting to look over-extended. Stock market returns this year — 27 per cent for the S&P, 18 per cent for the Russell — have been driven almost entirely by expansion in valuation multiples. Earnings estimates have only edged up. The S&P sits at 22 times earnings, the Russell at 27: not in a bubble, but expensive.

Meanwhile, the latest edition of the Bank of America Global Fund Manager Survey finds that sentiment is the most upbeat it has been since January of 2022, based on investor growth expectations and allocations to cash versus equities. And this is so even though almost all of the survey responses came in before last week’s Christmas-comes-early Fed meeting. Meanwhile, fund managers’ belief that inflation is beaten appears ironclad: bullishness on bonds is at a 15-year high and bearishness on commodities is at a six-year high.

If all of this makes you a bit nervous, the Fed appears to agree: various regional Fed chiefs have been marched out to talk down the possibility of imminent rate cuts. The market is loosening financial conditions more than the Fed would like. Torsten Sløk, Apollo’s chief economist, thinks the Fed has good reason to be concerned: he estimates that the Fed’s pivot, along with the recent decline in equity volatility, tighter credit spreads, and a falling oil price together could add 1.5 percentage points to gross domestic product growth over the next year or so. The central bank will have no choice but to respond to hotter growth, and “as we enter 2024, the pendulum will soon swing back from a dovish Fed to a more hawkish Fed”.

Yesterday’s letter suggested that we think the market’s current expectation of solid growth and six rate cuts seemed likely to be wrong in one direction or the other: either strong growth will limit the Fed to close to the three rate cuts it currently forecasts, or growth will be weak and there will be as many cuts as the market expects. In this sense, the market does look to be pricing in too much good news.

That said, it is important to explain why the Santa rally has been particularly good for lower-quality assets — the unprofitable, the leveraged, the outright dodgy. One explanation is that the market is pricing in perfection, a quick return to very low rates and better-than-trend growth rates. Another reading, however, is that all the market has done is excise the very worst-case scenario from the distribution of probabilities. Sustained high inflation, forcing the Fed to tighten until the economy enters deep recession, has been taken all the way off the table. Because that scenario could have all but wiped out low-quality assets, it makes sense that they would rally the most when it is priced out.

If that’s right — if we have priced a deep recession out, rather than pricing perfection in — then the possibility of growth that is a bit slower, or policy that is a bit tighter, than currently expected is less likely to lead to a nasty correction. We just have to avoid the worst.

Errata

Yesterday, I carelessly wrote that assets in US money-market funds had risen to $6bn; I meant $6tn.

One good read

“To adapt what Jefferson said about France, everyone . . . seems to have two countries now: their own and America.”

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Exuberance revisited appeared first on WorldNewsEra.