HuyNguyenSG/iStock Editorial via Getty Images

Boeing’s stock (NYSE:BA) on Wednesday swung from negative territory to little changed as the plane maker reported a wider-than-expected loss that included expenses to convert two 747 widebody planes for service as Air Force One, and on a satellite contract.

Boeing (BA) wrote off $482 million on the 747 conversions and $315 million on the satellite project for an unidentified customer.

Amid these losses, Boeing (BA) management is optimistic that increased defense spending will boost demand. The United States is setting aside more money to assist Ukraine and Israel in their respective military conflicts.

“The forecast for our weapons business…is getting more and more robust every day,” Dave Calhoun, president and chief executive of Boeing (BA), said in an interview on cable channel CNBC.

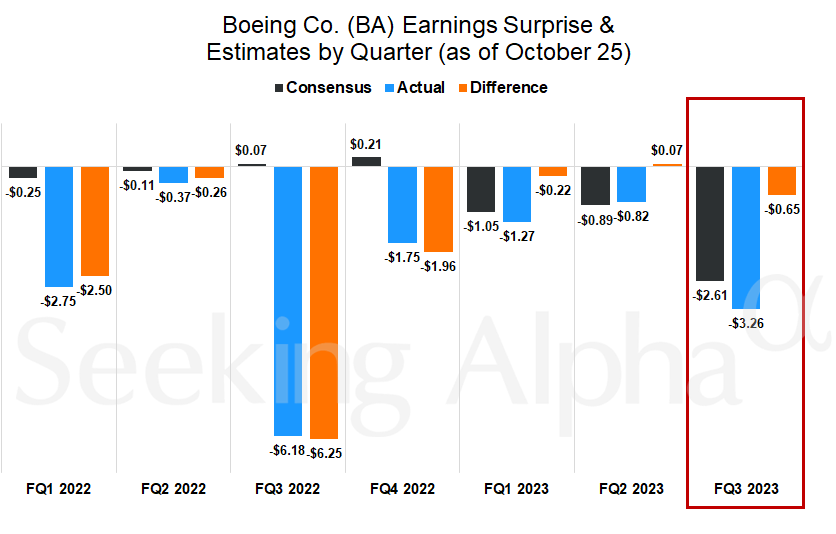

Boeing’s (BA) quarterly loss was deeper than forecast by Wall Street analysts. The company’s loss per share of $3.26 for the third quarter missed the consensus estimate of a loss per share of $2.61.

Revenue grew 13% from a year earlier to $18.1 billion, which the company attributed to 105 deliveries of commercial planes. Analysts had forecast revenue of about $18.3 billion.

Management reaffirmed its year-end guidance of $4.5 billion to $6.5 billion in operating cash flow and $3 billion to $5 billion of free cash flow.

Fewer 737 Deliveries

The company also cut its year-end delivery target for the best-selling 737 to a range of 375 to 400 planes, down from 400 to 450 of the narrowbody jetliner. The plane this year has been dogged by manufacturing defects such as misdrilled fuselage holes that needed to be fixed. The fuselage is the main body section of a plane.

Boeing (BA) and supplier Spirit AeroSystems (SPR) this month expanded fuselage inspections to hand-drilled holes from only those made by automated drilling. Boeing (BA) said there wasn’t any immediate flight-safety concern from the defect.

The company is looking to ramp up deliveries of the 737 after overcoming its manufacturing hurdles.

“We’ll get back to our full rate by the time we get to the end of the year,” Calhoun said on CNBC.

787 Output

Boeing (BA) kept its delivery goal of 70 to 80 of its 787 Dreamliner planes. The company said it’s set to increase monthly production of the widebody plane from four to five jets a month by the end of the year.

“I have heard those outside our company wondering if we’ve lost a step,” Calhoun wrote in a letter to employees. “I view it as quite the opposite.”

He said the manufacturing issues were identified with stricter internal oversight and a commitment to transparency.

“These are not newly created defects,” Calhoun said in the letter. “Thanks to the culture we’re building, we have identified non-conformances from the past that we now have the rigor to find and fix once and for all.”

Before Boeing (BA) reported results, Seeking Alpha contributor Dhierin Bechai said he the most important metrics to watch were the company’s guidance on future deliveries of new airplanes, which are directly tied to cash flow. Bechai also said a recent agreement between Boeing (BA) and a key supplier was significant, along with any commentary on whether plane deliveries will resume in China.

“There will be attention for the agreement reached with Spirit AeroSystems for the Boeing 737 Max and Boeing 787 program with the focus shifting from how the rates are today to what those production rates might look like next year,” Bechai said in an email to Seeking Alpha. “Management comment on production planning will increase insight and could ascertain investors that the projected production rates and cash flow targets for mid-decade are achievable.”

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Boeing trades sideways after plane maker reports mixed results (NYSE:BA) appeared first on WorldNewsEra.