Stay informed with free updates

Simply sign up to the Capital markets myFT Digest — delivered directly to your inbox.

A delightful new form of creditor-on-creditor violence just dropped: It’s called the double dip.

OK, it isn’t new, as similar set-ups were used to improve recoveries for some creditors in GM’s restructuring, for example. But a bunch of stressed companies have borrowed new cash from lenders this year by allowing them to “double dip”, giving those lenders not one but two claims on company assets.

For the companies’ earlier lenders who don’t get that deal, this adds insult to injury on top of getting “primed”, or having their claims on a company’s assets eroded by another creditor pushing ahead of them in line.

One of these companies was At Home, a “home and holiday superstore” that was LBO’ed by Hellman & Friedman in 2021. Since then the retailer has been grappling with a high debt burden, freight-cost inflation and sliding revenue, according to S&P Ratings. (It even got hit by price competition this year from the liquidation of inventories at Bed Bath & Beyond.)

To simplify a bit, At Home faced a liquidity crunch earlier this year. So the company created a subsidiary called “Cayman Sub”, which then borrowed $200mn to help pay down asset-backed loans. And not only was that new debt secured by guarantees from the parent company (and other subsidiaries), it also was used to fund an intercompany loan to the parent company.

That matters because the intercompany loan is . . . also pledged as security for the debt! How fun. So the $200mn in notes are secured by (1) a direct guarantee from At Home and (2) a liability on At Home’s balance sheet.

From S&P, with our emphasis:

After issuing the [$200mn in] notes, At Home Cayman lent the proceeds to At Home via an intercompany note. The intercompany note (an asset of At Home Cayman and an obligation of At Home) has the same guarantee and collateral package as, and ranks pari passu with, At Home’s other first-lien debt.

Moreover, the intercompany receivable is pledged as security for the $200 million senior secured notes . . . holders of the [$200mn Cayman] notes benefit from having dual independent claims: the [Cayman] notes have a claim against At Home and the guarantor subsidiaries through the guarantees and asset pledges provided directly by those entities; and the [Cayman] notes also benefit from the claim that At Home Cayman has against At Home and the guarantor subsidiaries by way of the intercompany note, which is an asset on At Home Cayman’s balance sheet.

The firm’s analysts estimate that the double-dipping lenders could recover approx 40 per cent of their investment in a default. The other senior lenders could get closer to 20 per cent, they wrote.

At Home was probably the most high profile example — see the posts from Max Frumes, law firm King & Spalding, and Reorg Research — but it isn’t the only company that’s let new lenders “double dip” this year. Texas-based company Sabre also did it, Reorg points out. The firm also included a nice lil diagram showing a typical “double dip” transaction:

© Reorg Research

And chemicals company Trinseo (formerly part of Dow Chemical) was extra creative as it borrowed $1.1bn for refinancing, according to Barclays’ credit analysts.

On top of the standard double-dip structure, Trinseo dropped its American Styrenics business into a new subsidiary and promised to use all of the proceeds from any sale of that business to pay down the loan.

Now, the Barclays credit analysts stress that these methods haven’t yet been tested in court. But they point out that companies generally use a few different contractual provisions to take on that extra debt; the companies must have the ability to take on new intercompany loans, take on senior debt and guarantee that debt. That means companies need to have some financial wriggle room to make this type of transaction happen.

Still, lawyers are creative! See also: One of the most famous liability-management transactions thus far, when J Crew was said to “J Screw” existing lenders by dropping a significant share of its intellectual property into a subsidiary and then using that asset to back new senior debt issuance.

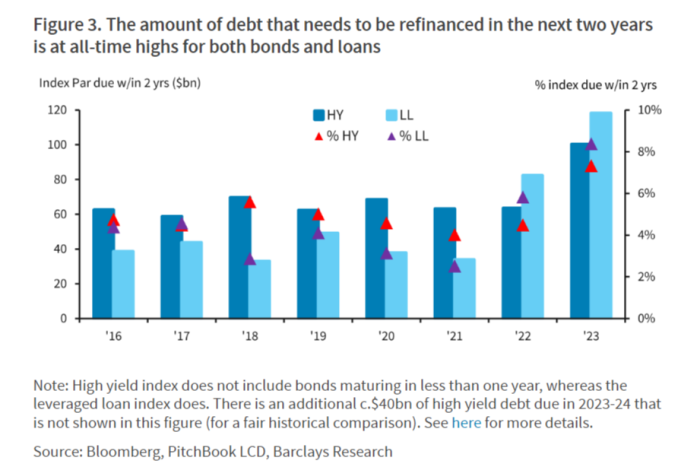

The broader point is that these types of “liability management exercises” — the euphemistic term for creditor-on-creditor violence — will probably become even more popular as a “wall” of junk-rated bonds and loans approach maturity in the next two years, says Barclays:

At the same time, these types of transactions are seen as companies and lenders playing hardball. So which lenders are going to be willing to risk the ire of the rest of their industry? Barclays says private credit funds seem like a good candidate:

Surpassing $1.6trn in global AUM during 1Q23, private creditors have also shown they are willing and able to participate in sizeable refinancings throughout 2023. The growth of private credit dry powder, along with the increasing frequency and complexity of LMEs such as double-dips, creates a unique backdrop as the 2025-26 maturity wall approaches.

‘Golden moment’ indeed!

While it’s clear that this type of gamesmanship is helpful for financially stressed companies — at least for a while — there could be a silver lining for opportunistic credit traders as well.

Companies’ short-dated bonds often trade at steep discounts when investors have concerns about their ability to refinance or pay down upcoming maturities. If the companies instead choose to raise cash proactively (well . . . aggressively) and retire near-term debt, that could mean those short-dated bonds are a good trade (even if its –cough- less great for longer-term creditors that get shafted in the process).

Barclays even tapped its analysts to find some company names that have upcoming maturities, and may be at risk of committing some creditor-on-creditor GBH.

Some of the bigger names include yoghurt brand Chobani; office-supply store Staples; Abercrombie & Fitch; Neiman Marcus; Community Health; Ardagh Group; and even Altice. Bonne chance.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Double dipping: not just for crudités appeared first on WorldNewsEra.