Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. The world largest company by market cap, Apple, reported earnings yesterday and beat expectations for revenue and earnings. But not by enough, apparently. The shares fell a bit in late trading. More evidence that Big Tech stocks have gotten ahead of themselves. If you still think Apple is cheap, tell us why: robert.armstrong and ethan.wu.

Are we there yet?

Market moods and market narratives change quickly. Before this week began, the mood had been pretty dour for several months, despite consistently strong news about growth. This has a lot to do with a steady increase in long-term interest rates and inflation that wasn’t declining quickly enough. The slogan was “higher for longer”, and stocks didn’t like it one bit.

That anxious psychological regime seems to have disappeared — all at once — during Federal Reserve chair Jay Powell’s press conference on Wednesday. The changes have been dramatic. Most importantly, the 10-year yield has fallen a striking 25 basis points over two days. The shorter end of the curve has fallen only a third as much, suggesting that the market did not hear Powell hinting at an imminent cut, but rather at easier policy in the medium-term. The rate futures market broadly agreed, but was less vigorous: it added about half a rate cut into expectations for the middle of next year.

Shares were thoroughly revived — they rose almost 2 per cent, and the increase was broad-based: the S&P equal weight index outperformed the cap-weighted S&P, and small caps outperformed big caps. There was a stonking rally in small and lower-quality tech names: Roku, Shopify, Affirm, Palantir, DoorDash and Carvana all rose more than 15 per cent, helped by solid earnings reports. Regional banks, heretofore a hated group, rose strongly, too — another sign that investors expect relief on interest rates.

We are a bit surprised by all this; we did not hear anything in Powell’s comments that signalled a fundamental change in Fed posture. What is going on, then? Our guess is that markets are hearing what they want to hear, which is that the rate increase cycle is almost certainly over. For months, analysts and pundits have been writing that the uncertainty and volatility that have characterised the market in recent months will dissipate only when the last rate increase is in the books. Markets are daring to hope that the moment we have all been waiting for has arrived.

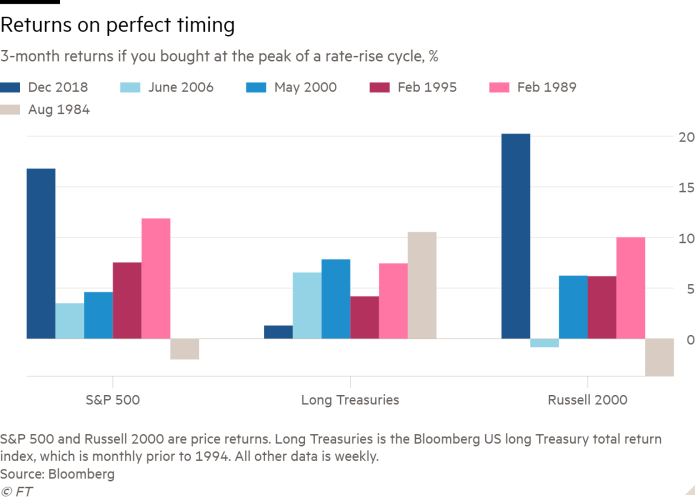

We sympathise. Going back to 1984, traders who have correctly called the top of the rate cycle have been well rewarded. The chart below illustrates. It shows average three-month returns after buying large caps, small caps and long bonds at different points. For stock market investors, buying just as rates peak (specifically, during the week of the last rate increase) has brought handsome returns relative to buying three months earlier, or during the week of the first rate cut:

The next chart breaks down this perfect-foresight trade by cycle. Not every cycle rewards good timing equally well, but the results are almost uniformly positive:

By contrast, buying prematurely, three months before rates peak, is (usually) an OK trade, but with less upside and more downside:

Waiting to buy once rates start to fall — that is, once everyone can see that the rates cycle is past its zenith — is no guarantee of good returns on stocks (though bonds tend to do well):

It is important, however, not to look at the economic data selectively. Not all of it suggests that the cycle is clearly over.

Yes, jobless claims have nudged up over the past couple weeks. Wednesday’s ISM manufacturing PMI for October came in below 47, in contraction and well below expectations. That ISM reading was bad enough to knock more than 1 percentage point off the Atlanta Fed’s GDPNow growth estimate, including halving the estimate of real consumer spending. GDPNow is currently tracking 1.2 per cent growth for the fourth quarter, a broad-based slowdown. Perhaps that clears the way for the Fed to take further increases off the table?

Not so fast. The ISM manufacturing PMI measure is in conflict with S&P Global’s October manufacturing survey, which posted a nice round 50. And even if fourth-quarter growth does roll in at 1.2 per cent, that would still leave full-year GDP growth at 2.6 per cent, hardly a slow economy. That is an environment where the labour market could very plausibly keep posting sturdy payroll and wage gains, firming up inflation. The Fed has no GDP mandate. What matters is inflation and the labour market. A market convinced that the central bank is done places itself at the mercy of the data.

Remember, as well, that growth slowing is not by itself compatible with bonds and stocks both rallying. That would require movement towards a soft landing — the perfect amount of inflation-busting slowing, but no more. Jonathan Pingle, chief US economist at UBS, argues that rate increases are beginning to weigh on consumers and the economy. He notes that personal interest payments relative to income have risen more than a percentage point in the past year, and that consumers are borrowing and dipping into savings to maintain spending. The bar is high for further consumption growth, and so he remains in the mild recession camp.

Lastly, remember what had markets worried just a fortnight ago: the rising term premium, $80 oil, Treasury oversupply. All were pointing towards higher for longer. None of that has gone away. (Armstrong & Wu)

One good read

China’s social contract has fractured.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post It ain’t over till it’s over appeared first on WorldNewsEra.