One of the biggest financial crises of the year unfolded in March when Silicon Valley Bank couldn’t balance its bond portfolio and went under. That’s the kind of situation Clearwater Analytics (CWAN) thinks it could have prevented.

X

Clearwater offers software designed to help investment managers see such problems before they become a major issue. The fintech’s software-as-a-service is designed to deliver automated investment accounting, performance, compliance and risk reporting.

Clients include banks, insurance companies and governments. And Clearwater is up against software from established players such as SS&C Technologies (SSNC), BlackRock (BLK) and State Street (STT) in this highly specialized space.

D.A. Davison analyst Peter Heckman told Investor’s Business Daily that many investment managers use “rather old” pieces of software. These are licensed, on-premise models that lack the automation baked into Clearwater programs.

“In the case of Clearwater it’s a completely cloud-native software system,” he said. “They never sold this software on an on-premise basis; they started as a cloud-based provider.”

Greater Visibility Across Portfolios

The firm serves entities that manage assets, but its main customers are insurance companies that invest in low-risk fixed-income areas. There also are asset managers and corporate treasuries.

Clearwater’s automation can help investment managers compile portfolio reports more regularly — perhaps daily rather than weekly. This is particularly important for Treasuries, where real-time pricing tends to be a manualized process due to the illiquid nature of the assets.

RBC Capital Markets Managing Director Rishi Jaluria said Clearwater Analytics’ products could have helped avert the Silicon Valley Bank debacle.

“Every investment should have more visibility to real-time pricing. When you are buying 30-year Treasury (notes) and we’re suddenly in a rising-interest-rate environment, these assets become a lot more volatile,” he told IBD. “I do think that that’s a great illustrative example that you should have a real-time visibility into things and have it done in an automated fashion.”

In fact, the fallout from the banking crisis could end up benefiting the firm if regulators task banks with keeping a closer eye on portfolio risk, says Oppenheimer Managing Director Brian Schwartz.

“If you think about what happened with Silicon Valley Bank and the failure to properly manage risk, that likely means there are new (regulatory) changes that are coming in,” he told IBD.

Analysts See Plenty Of Growth Ahead

Winning new customers is a key plank of Clearwater’s growth strategy.

They already have a battery of big-name clients that includes JPMorgan Chase (JPM), Robinhood (HOOD), Zillow (ZG), Meta Platforms (META) and Aviva. Aviva is the UK’s largest general insurer.

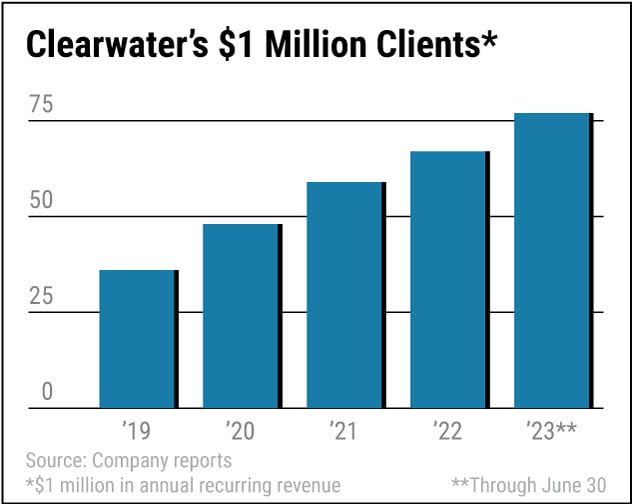

Progress on this front is stout. The number of customers offering annual recurring revenue of $1 million or more grew to 77 by June. That’s more than double the 36 it had at the end of 2019.

Jaluria expects to see revenue growing by at least 20% for the next several years.

“I think earnings will grow faster than that because there’s also margin expansion on top of that,” he said. “They did talk about 40% longer-term EBIDTA margins and the glide path to get there.”

Clearwater Analytics Offers Clients AI

But simply getting new clients isn’t enough — you also have to keep the ones you have. Here Clearwater is also strong, boasting a 98% retention rate.

“One of the things that stands out to me is the level of customer enthusiasm I’ve seen when I’ve gone to Clearwater conferences, where I’ve talked to Clearwater customers,” RBC’s Jaluria said. “They are enthusiastic about the product and are getting a lot of value out of it, and it does save a lot of time and money.”

According to Jaluria’s research, it is delivering real-time cost savings. It also works as a more robust and easier-to-use platform than the competition.

And the firm is rolling out new projects to keep their customers engaged. The firm has launched Clearwater GPT, which brings the benefits of artificial intelligence to its suite of products.

The firm said this will allow their clients to access their data through interactive prompts. That will provide “insightful, accurate, tailored” AI-generated content, Clearwater said.

“We are working on rolling out new-gen AI-driven solutions and dramatically improving the way we service clients. Clearwater GPT is the first solution of its kind that seeks to address the full investment life cycle,” Chief Executive Sandeep Sahai said during the company’s second-quarter earnings call. “We see this effort as both adding to the revenue growth of the company with new-gen AI-based product offering and impacting the bottom line with efficiencies across our operations.”

Overseas Expansion Seen As Big Opportunity

Boise, Idaho-based Clearwater Analytics spent many years focusing on the domestic market. Now, it has offices in London and Edinburgh in the U.K. as well as in India.

And in November, the firm further expanded its global footprint when it completed the acquisition of Paris-based Jump Technology. The purchase allows Clearwater to provide an end-to-end platform for the hedge fund and investment management industry. CEO Sahai said the move gave Clearwater “immediate scale in Europe” as it further bolstered its product offerings.

D.A. Davidson’s Heckman believes Clearwater’s international business could be a key growth area.

“Within a couple of their niches, like in insurance, I think there could be more opportunity outside the U.S. than in the U.S.,” he said.

Heckman added that the company’s November 2021 initial public offering took out most of the firm’s debt and put them on a footing to concentrate on overseas expansion.

“In 2021 I think it’s fair to say the company generated less than 3% of revenue internationally. At the end of the second quarter it was about 17% internationally, so they’ve had great success,” he said.

Clearwater Analytics Clears This Hurdle

On Nov. 1, Clearwater Analytics posted results, with adjusted earnings jumping 50% to 9 cents a share. This was clear of Wall Street expectations. Over the past three quarters, earnings have grown by an average of 44.4%.

Revenue rose 24% to $94.7 million.

There has been slightly more buying than selling among institutions of late, with CWAN’s Accumulation Distribution Rating coming in at C+. Shares also boast four straight quarters of increasing fund ownership. In total, 68% of Clearwater stock is currently held by funds.

Clearwater stock has just retaken its key 50-day moving average, MarketSmith analysis shows. This could serve as an entry point for aggressive investors. This comes after it flashed a round-trip sell signal. It did so by giving up a double-digit gain from a cup-with-handle entry of 18.

Overall performance is outstanding, with its IBD Composite Rating coming in at a best-possible 99. CWAN also is in the top 11% of issues in terms of price performance over the past 12 months. But its relative strength line has been slipping of late.

CWAN stock could be in the process of forming a new base. It could eventually yield an entry point of 20.73.

Please follow Michael Larkin on X, formerly known as Twitter, at @IBD_MLarkin for more analysis of growth stocks.

YOU MAY ALSO LIKE:

These Are The 5 Best Stocks To Buy And Watch Now

Join IBD Live Each Morning For Stock Tips Before The Open

This Is The Ultimate Warren Buffett Stock, But Should You Buy It?

Checkout latest world news below links :

World News || Latest News || U.S. News

The post New Approach Could Help This Firm Prevent Another Silicon Valley Bank appeared first on WorldNewsEra.