Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew

One scoop to start: The IMF has urged regulators to bear down on the liquidity risks presented by life insurers linked to private capital groups, warning of potential “contagion” to the wider financial sector and the real economy after a shift in ownership in the sector. Groups including Apollo, Blackstone, Carlyle and KKR have flooded into insurance since the global financial crisis.

How to curb basis trade risk?

The US Securities and Exchange Commission, which regulates hedge funds, has proposed a new regime for the Treasury market that would treat hedge funds like the broker-dealer arms of banks.

My colleague Costas Mourselas and I interviewed one high-profile financier who (unsurprisingly) does not agree: Ken Griffin. “Well he would, wouldn’t he?”

The founder and chief executive of $62bn US hedge fund Citadel thinks that regulators should focus their attention on banks rather than his industry if they want to reduce risks in the financial system stemming from leveraged bets on US government debt.

Readers will recall that global regulators have warned about growing risks emerging from the so-called Treasury basis trade — selling Treasury futures while buying US government bonds and extracting gains from the small gap between the two using borrowed money.

Such are the leverage levels (sometimes in excess of 100 times) that if the trade moves against them and hedge funds are forced to sell their Treasury bonds at the same time, regulators worry it could lead to a collapse of the world’s most important bond market, with severe implications for the wider financial system.

But Griffin said they should focus on the risk management of banks that enable the trade by lending to hedge funds, rather than try to increase regulation of the hedge funds themselves.

“The SEC is searching for a problem,” Griffin told us. “If regulators are really worried about the size of the basis trade, they can ask banks to conduct stress tests to see if they have enough collateral from their counterparties.”

Hedge fund bets against US Treasuries futures climbed to new highs in the seven days to October 24, with record net shorts against both the two-year and five-year future. Most, but not all, of these bets are in the basis trade, which is routinely used by managers such as Citadel, Millennium Management and Rokos Capital Management.

Griffin argues that the basis trade brings down the cost of issuing government bonds, as hedge funds buy large quantities of Treasuries to pair against their short futures positions.

On the other side of the trade, “the ability for asset managers to efficiently gain exposure to Treasuries through futures allows them to free up cash to invest in corporate bonds, residential mortgages and other assets,” he said. This is because futures are leveraged products requiring a fraction of the cash posted as collateral to maintain the position, rather than paying full price for a Treasury bond now. He added:

“If the SEC recklessly impairs the basis trade, it would crowd out funding for corporate America, raising the cost of capital to build a new factory or hire more employees. It would also increase the cost of issuing new debt, which will be borne by US taxpayers to the tune of billions or tens of billions of dollars a year.”

Do you agree? Email me: harriet.agnew And read the full interview here

Goldman’s next big growth bet

Marc Nachmann, pictured, one of David Solomon’s trusted lieutenants, is charged with carrying out a wealth strategy to help Goldman Sachs close the gap on Morgan Stanley © FT montage/Bloomberg

Goldman Sachs is in a race against time. It must show it can grow fees in its newly merged asset and wealth management division quickly enough to balance investment banking and trading, write Brooke Masters and Joshua Franklin in this deep dive.

As the US bank’s chief executive David Solomon has had to deal with discontent among both rank-and-file employees and the executives displaced in last year’s restructuring, his job security may depend on it.

Solomon’s new strategy relies on the bank building up stable, fee-generating business while unwinding billions in proprietary investments to free up capacity to do more for clients.

The man charged with doing it is Marc Nachmann, one of Solomon’s trusted fixers, who previously boosted trading revenues and was elevated to the position of global head of asset and wealth management during last year’s restructuring.

Goldman executives said they “see a path” to generating a quarter of profits from the division, which has with $2.7tn in assets under supervision, by the end of 2025. AWM could contribute $4bn to $5bn in pre-tax earnings by then, president John Waldron told the Financial Times.

That would be more than three times the $1.3bn the unit generated in 2022, which was about 10 per cent of the bank’s total. Pre-tax earnings across Goldman have averaged $17.7bn over the past three years.

“It’s an exciting business because you’ve got secular growth and a pretty fragmented marketplace when you compare it to banking,” Nachmann said.

Read the full story here in which we look at how Goldman is betting that supercharging alternatives and aiming for the richest clients will help it overcome the fallout from repeated reorganisations and turnover at the top of AWM that have taken their toll on investor confidence and internal morale.

AWM “has always been ‘the other business’,” said a very senior banker who has worked at several rivals.

“Fifteen years ago it was 8, 9, 10 per cent of earnings and they wanted to get it to 15, 20 per cent. That’s still true now . . . They should accept they don’t know how to expand the business and hire a big cheese.”

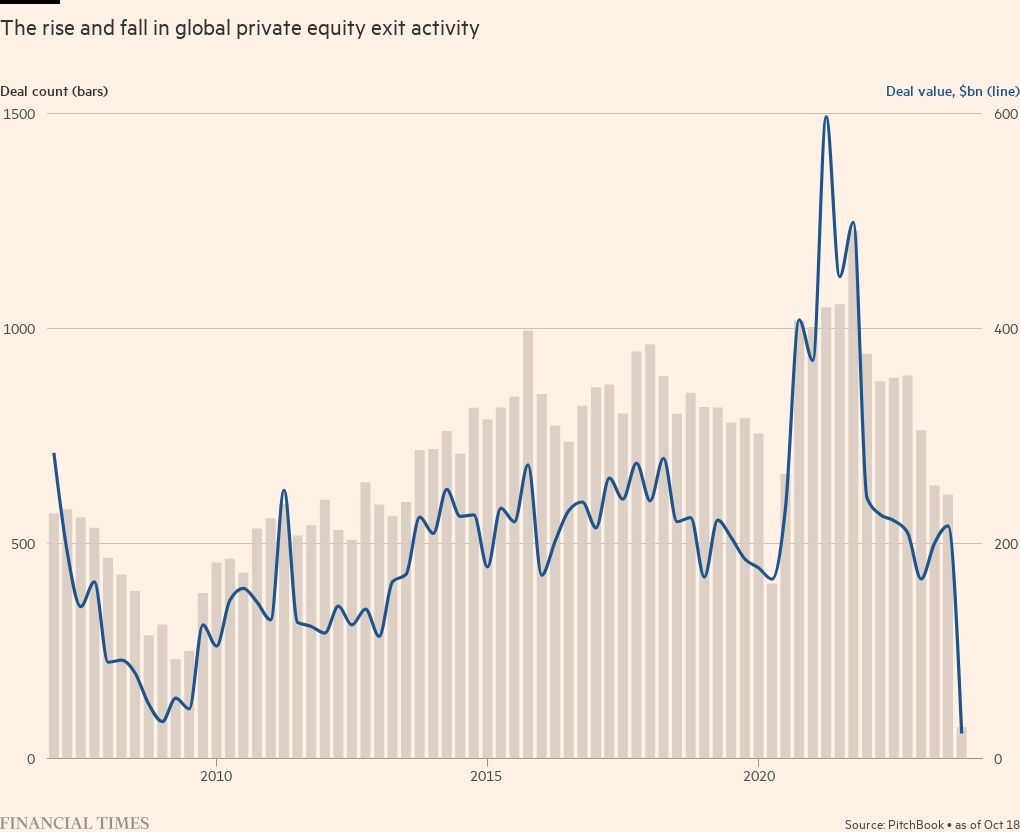

Chart of the week

The prospect of rates staying higher for longer is having powerful ripple effects across the economy; companies large and small are struggling to refinance debt, while governments are seeing the cost of their pandemic-era borrowings rise.

But private equity is the industry that surfed the decade and a half of low interest rates, using plentiful and cheap debt to snap up one company after another and become the new titans of the financial sector, write Antoine Gara, Eric Platt and Will Louch in this unmissable Big Read.

“Many of the reasons these guys outperformed had nothing to do with skill,” says Patrick Dwyer, a managing director at NewEdge Wealth, an advisory firm whose clients invest in private equity funds.

“Borrowing costs were cheap and the liquidity was there. Now, it’s not there,” he adds. “Private equity is going to have a really hard time for a while . . . The wind is blowing in your face today, not at your back.”

Facing a sudden hiatus in new money flowing into their funds and with existing investments facing refinancing pressure, private equity groups are increasingly resorting to various types of financial engineering.

They have begun borrowing heavily against the combined assets of their funds to unlock the cash needed to pay dividends to investors. Another tactic is to shift away from making interest payments in cash, which conserves it in the short term but adds to the overall amounts owed.

Some view the financial engineering as a symptom of a deepening crisis. They say a modus operandi that thrived in an environment of low interest rates will look very different if rates stay higher for some time.

“The tide has gone out,” says Andrea Auerbach, head of private investments at Cambridge Associates, which advises large institutions on their private equity investments. “The rocks are showing and we are going to figure out who is a good swimmer.”

Elsewhere in private equity land, European group CVC Capital Partners has postponed plans to float until next year because of market turbulence, extending a two-year saga over whether it will follow rivals on to the public markets.

Five unmissable stories this week

A new trading firm is launching that is designed to trade on market-moving news unearthed by its own investigative reporting. Hunterbrook, founded by investor Nathaniel Brooks Horwitz and writer Sam Koppelman, will comprise two entities: a hedge fund and a group of analysts and journalists producing stories based on publicly available material. Here’s a look inside

Jack Bogle, founder of passive pioneer Vanguard, once described active managers as “the greedy parasite who eats away at the host”. But columnist Toby Nangle writes in this opinion piece that while it’s hard to argue with that assessment in aggregate when discussing mutual funds, private assets or in US large-cap stocks, when working for large institutional investors, active managers have defied this.

Odey Asset Management is to close five months after allegations of sexual assault and harassment against its founder, Crispin Odey, plunged one of London’s oldest hedge fund groups into crisis. The group, which includes Brook Asset Management and Odey Wealth, will be closing. Fund managers and funds have moved to new asset managers.

Berkshire Hathaway’s cash pile surged to a record $157bn in a quarter in which chief executive Warren Buffett continued to sell stakes in publicly traded companies, as the so-called Oracle of Omaha found a dearth of appealing investments.

A $111bn investment boutique owned by BNY Mellon is seeking seed capital from investors to enter the multi-manager hedge fund business dominated by the likes of US giants Citadel and Millennium. Newton Investment Management is pitching investors a multi-manager hedge fund with teams trading equities, currencies, commodities, bonds and quant strategies.

And finally

Vincent van Gogh, ‘Wheatfield with Crows’ (July 1890) © Van Gogh Museum, Amsterdam

Often painting two canvases a day, Vincent van Gogh produced 70 works in his final prolific months. A new exhibition at the Musée d’Orsay in Paris, Van Gogh in Auvers-sur-Oise: The Final Months, gathers the majority of them. “Ah well, really we can only make our paintings speak,” Van Gogh wrote in a note found at his death on July 29 1890. To February 4, musee-dorsay.fr

FT Live event: Future of Asset Management Europe

Hosted by the Financial Times, in collaboration with Ignites Europe, Future of Asset Management Europe is taking place on 14-15 November at the Carlton Tower Jumeirah in London. The two day event will bring together senior leaders from Europe’s leading asset and wealth management firms, including BlackRock, Legal & General and Federated Hermes. For a limited time, save up to 20 per cent off on your in-person or digital pass. Register now

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Ken Griffin warns against hedge fund clampdown appeared first on WorldNewsEra.