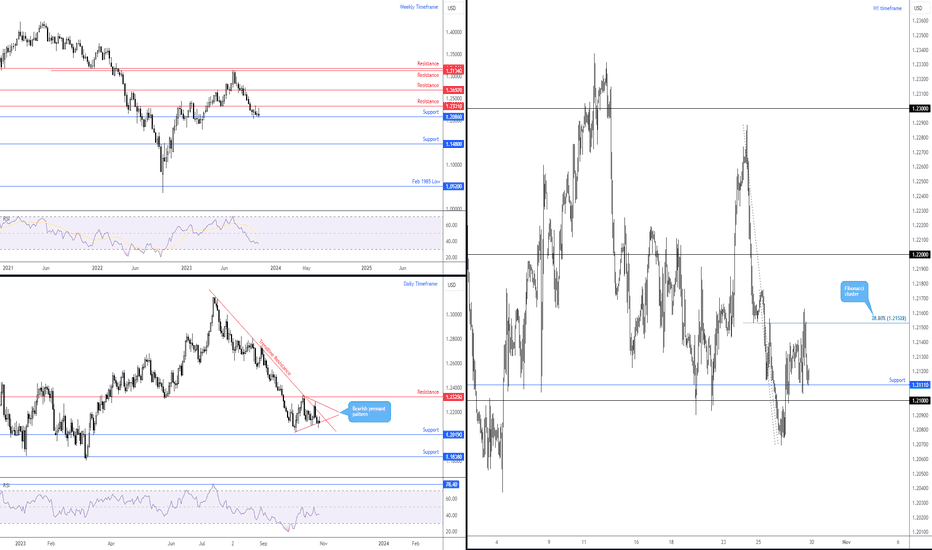

GBP/USD: $1.21 Vulnerable to the Downside?

The technical landscape offers an interesting perspective ahead of the Bank of England’s (BoE) rate decision on Thursday. With the market widely anticipating a no-change out of the central bank, price action on the weekly timeframe has buyers and sellers battling for position between resistance from $1.2331 and support coming in from $1.2086. Interestingly, should the aforesaid support relinquish its position over the coming weeks, aside from the $1.1850ish lows, limited support is evident until $1.1480. Clearly, then, $1.2086 support is a key level to be mindful of.

From the daily timeframe, price action is seen compressing between two converging lines ($1.2037 and $1.2337) to establish a bearish pennant pattern at trendline resistance taken from the high of $1.3142. With the pair currently testing the limits of the pattern’s lower boundary and this market trending lower since July, a breakout to the downside could be on the table over the coming days, unearthing support from $1.2019, followed by another layer of support at $1.1838.

Both the weekly and daily timeframes also show the Relative Strength Index (RSI) sub-50.00 (negative momentum).

Across the page on the H1 scale, we can see that the unit momentarily investigated space beneath the $1.21 handle in the second half of last week before reclaiming $1.21+ and retesting neighbouring support at $1.2111. Overhead, the chart also shows price tested a mild Fibonacci cluster at $1.2153 on Friday, made up of 38.2% and 78.6% Fibonacci retracement ratios. Above $1.2153 re-opens the risk of a return to $1.22, while below $1.21 shines light on daily support from $1.2019.

Ultimately, having seen the daily timeframe’s bearish pennant pattern forming at trendline resistance in a market trending lower, along with the RSI on both the weekly and daily charts beneath 50.00, technical selling could remain firm beneath the current H1 Fibonacci cluster at $1.2153. This is particularly likely for those anticipating a breakout lower (daily pennant pattern) to target daily support at $1.2019.

The caveat, nonetheless, is weekly support remains in play at $1.2086. With that, conservative sellers will likely want a H1 close to form below $1.21 before committing.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post GBP/USD: $1.21 Vulnerable to the Downside? for FX:GBPUSD by Aaron-Hill appeared first on WorldNewsEra.