Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

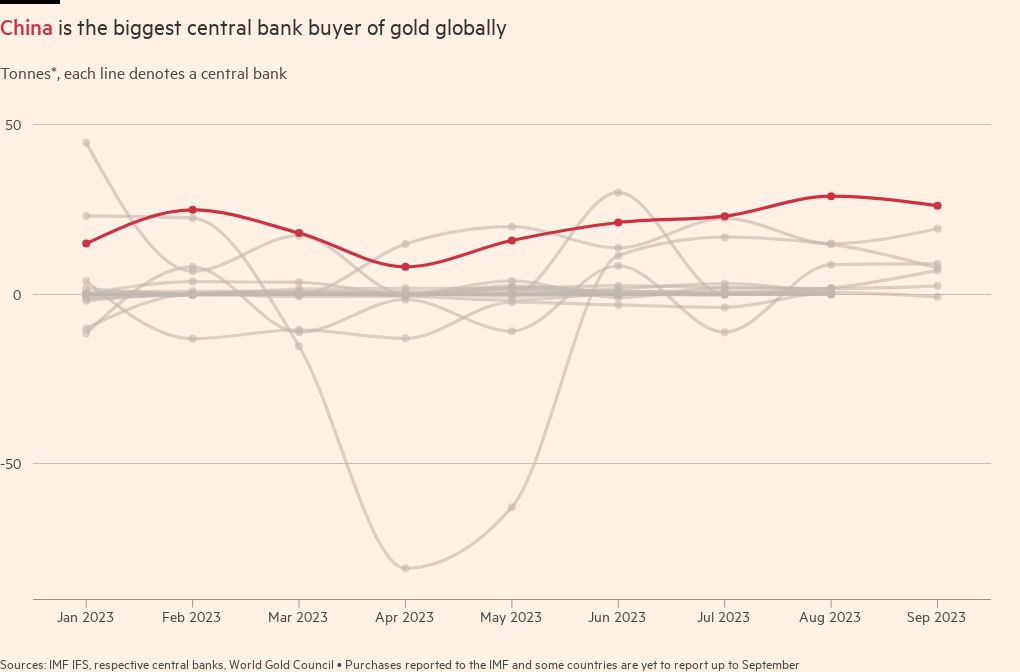

China has spearheaded record levels of central bank purchases of gold globally in the first nine months of the year, as countries seek to hedge against inflation and reduce their reliance on the dollar.

Central banks have bought 800 tonnes in the first nine months of the year, up 14 per cent year-on-year, according to a report by the World Gold Council, an industry group.

The “voracious” rate of buying has helped bullion prices defy surging bond yields and a strong dollar to trade just shy of $2,000 a troy ounce.

Surging consumer prices and depreciating currencies in many markets has triggered a rush to gold as a store of value, while the yellow metal has also historically been held when global inflation rises.

The rush to gold by central banks is also driven by countries’ desire to weaken their dependence on the US dollar as a reserve currency, after Washington weaponised the greenback in its sanctions against Russia.

China has stood out as the largest purchaser of gold this year as part of a 11-month buying streak. The People’s Bank of China has reported snapping up 181 tonnes this year, taking gold holdings to 4 per cent of its reserves.

Poland, at 57 tonnes, and Turkey, with 39 tonnes, followed as the next largest buyers in the third quarter. A further eight banks purchased more than 1 tonne.

The continued rapid rate of central bank buying has taken market analysts by surprise, who had been expecting an easing of purchases from last year’s all-time high.

Those concerns will have been further stoked by the conflict that has erupted in the Middle East between Hamas and Israel, which has lifted the safe haven asset almost 10 per cent in 16 days.

John Reade, chief market strategist at the WGC, said that it expected the annual total of official purchases of gold to “get close to or exceed” last year’s 1,081 tonnes.

Central banks report gold acquisitions to the IMF but global flows of the yellow metal suggest that the real level of buying by official financial institutions — especially China and Russia — has been far higher than officially reported.

The WGC estimated 129 tonnes of central bank purchases above what was officially reported in the third quarter, taking overall official sector buying to 337 tonnes. The total was more than double of the previous quarter but down 27 per cent on the same period a year ago.

In August, BMO analysts wrote that its analysis suggested that privately owned gold holdings and those under the central bank in China “are significantly higher than annual consumer demand and official purchases might suggest”.

Chinese central bank gold buying, along with a weak renminbi, vapid local stock market and troubled real estate sector, has also encouraged the country’s consumers to rush towards purchasing bullion to store their wealth.

Those factors have helped keep gold prices not far from its all-time high of $2,072 a troy ounce, despite investors increasingly believing that the US Federal Reserve will keep interest rates “higher for longer”. That led to $8bn of outflows for gold-backed exchange traded funds in the third quarter.

Overall, gold demand excluding bilateral over-the-counter flows was 6 per cent weaker year-on-year at 1,147 tonnes.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post China leads record central bank gold buying in first nine months of year appeared first on WorldNewsEra.