Uber (UBER) and Axon Enterprise (AXON) have retaken their 50-day moving averages as they head into earnings the coming week.

X

Other companies lining up for earnings include one of Warren Buffett’s top holdings, Occidental Petroleum (OXY), new chip issue Arm (ARM) as well as Twilio (TWLO) and Robinhood (HOOD), both holdings of Cathie Wood’s Ark Invest funds.

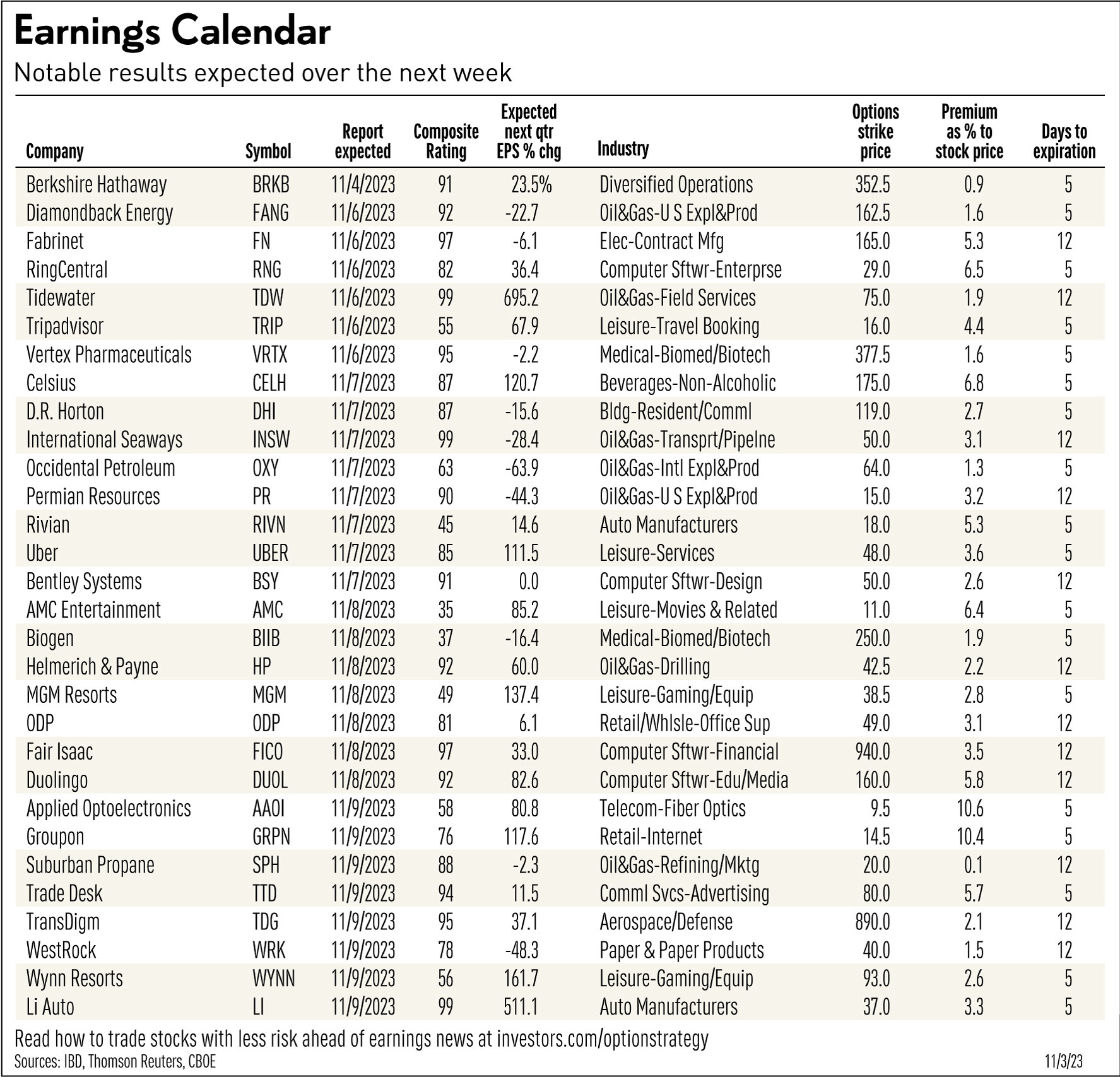

Also of note in the earnings calendar are Fair Isaac (FICO) and Uber rival Lyft (LYFT). Scorpio Tankers (STNG) also reports as the energy sector tries to rebound. But the stock is extended from its latest buy point.

The stock market is in a confirmed uptrend as yields ease from multidecade highs.

Uber reports its third-quarter results Tuesday before the market opens. Lyft reports Wednesday after the market close, along with Occidental Petroleum, Twilio and Arm. Axon and Robinhood are due Tuesday after the close. FICO also announces Wednesday after the market close.

Earnings Calendar Underscores Uber-Lyft Rivalry

A closely watched contest between ride-sharing rivals Uber and Lyft continues. But recent reports say Lyft is losing market share to its competitor. The two stocks seem to reflect that.

Uber stock has surged nearly 90% this year despite a pullback in recent weeks. The stock ranks third in the leisure services industry group, per IBD Stock Checkup. Its relative strength line is near a new high, and the stock is forming a base with a 49.49 buy point.

In contrast, Lyft stock has had a dismal year so far, down 10% and below the 10-week moving average.

Although Uber’s sales growth tapered to 14% in the second quarter, earnings of 18 cents per share surprised investors after a loss of $1.32 per share in the prior-year quarter. Revenue from its ride-sharing business jumped 40% due to an increase in bookings, while its delivery segment grew sales 17%. Its freight and logistics segment saw revenue decline from the prior year.

Analysts polled by FactSet expect sales of $9.5 billion, or a 14% increase from the prior year, and earnings per share of 7 cents in the third quarter, reversing from a year-ago 61-cent loss.

In the safety and security group, Axon stock is rebounding after a two-week decline. It is trying to regain the 217.61 buy point of a cup with handle, according to IBD MarketSmith pattern recognition. Another entry is appearing at 223.30.

Sales growth for the maker of Taser stun guns ranged from 31% to 54% over the past six quarters, while earnings growth accelerated in the three most recent quarters by 52%, 96% and 152%.

FactSet consensus estimates place third-quarter sales at $391.2 million, or 25% growth from the prior year’s quarter, and a 27% increase in earnings to 76 cents per share. Leadership is seen in its perfect Composite Rating and EPS Rating of 99 and Relative Strength Rating of 92. Axon also has an Accumulation/Distribution Rating of B+.

Options Trading Strategy

A basic options trading strategy around earnings — using call options — allows you to buy a stock at a predetermined price without taking a lot of risk. Here’s how the options trading strategy works and what a call option trade recently looked like for ride-sharing stock Uber, a noteworthy stock in the current earnings calendar.

First, identify top-rated stocks with a relatively good chart. Some might be setting up, showing signs of forming early-stage bases. Others already might have broken out and may be getting support at their 10-week lines after a strong shakeout.

And a few might be trading tightly near highs and refusing to give up much ground. That would be an encouraging sign of limited overhead supply.

A call option is a bullish bet on a stock. Put options are bearish bets. One call option contract gives the holder the right to buy 100 shares of a stock at a specified price, known as the strike price and expires on a particular date in the future.

Once you’ve identified an earnings setup for a call option, check strike prices with your online trading platform, or at cboe.com. Make sure the option is liquid, with a relatively tight spread between the bid and ask.

Look for a strike price just above the underlying stock price — that’s out of the money — and check the premium. Ideally, the premium should not exceed 4% of the underlying stock price at the time. In some cases, an in-the-money or at-the-money strike price is OK as long as the premium isn’t too expensive.

See Which Stocks Are In The Leaderboard Model Portfolio

Choose an expiration date that fits your risk objective. But keep in mind that time is money in the options market. Near-term expiration dates will have cheaper premiums than those further out. Buying time in the options market comes at a higher cost.

Earnings Calendar And Option Trades For Uber, Axon

A call option on Uber with a strike price of 47 and a Nov. 10 expiration cost $1.82 per contract Thursday afternoon. Based on the closing price of the stock of 46.48 Thursday, the premium was 3.9% of the stock’s price.

One contract gave the holder the right to buy 100 shares of Uber at 47 per share. The most that investors could lose was $182 — the amount paid for the 100-share contract. Uber would have to rally past 48.82 (the strike price plus the cost of the option) for the trade to make money.

A slightly at-of-the-money call option for Axon with a strike price of 210 and Nov. 7 expiration cost $10.95, which was 5.2% of the underlying stock price when Axon was trading around 210. To break even, Axon would have to climb past 220.95 (strike price of 210 plus $10.95 premium per contract).

Remember to keep in mind the size of the trade. To take ownership of the shares, investors would have to commit $22,095.

A much bigger outlay would be needed in the case of FICO, whose stock is trying to regain a buy point of 916.41. An out-of-the-money call option with a strike price of 910 and an expiration date of Nov. 17 would cost $33.70, which was 3.7% of the stock price when FICO traded at 900. Executing one contract would cost a hefty $94,370 including the premium.

Please follow VRamakrishnan on X/Twitter for more news on the stock market today.

YOU MAY ALSO LIKE:

Top Growth Stocks To Buy And Watch

Learn How To Time The Market With IBD’s ETF Market Strategy

Find The Best Long-Term Investments With IBD Long-Term Leaders

MarketSmith: Research, Charts, Data And Coaching All In One Place

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Ride-Share Wars Grow As Uber, Lyft Highlight Earnings Calendar; Taser Maker Also On Deck appeared first on WorldNewsEra.