What caught my eye this week.

Last week we lamented how much poorer we feel than a few years ago.

Inflation has watered down the real terms value of our investment portfolios like a cheap nightclub barman diluting away our drinks. It’s reduced the potency of every pound we spend.

Nevertheless it was still quite a bender we went on.

So we knocked back higher rates to sober us up. But that in turn has given us an almighty hangover.

The typically steadier bond market has looked particularly sickly. Watching bonds puke for the past 18 months has been akin to learning the day after a wedding why your prim parents don’t usually drink anymore.

The good news is that the sickness of inflation and the cure of higher rates could now both be at the point of not getting any worse.

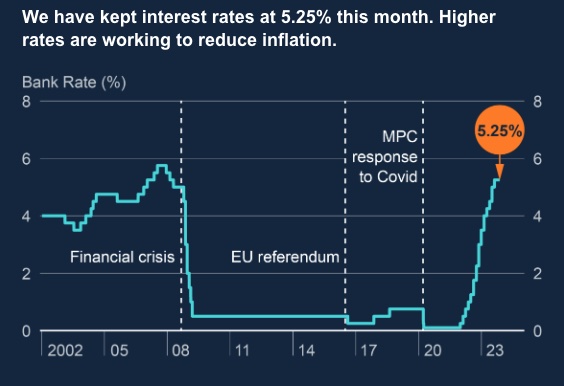

Inflation actually turned a while ago. Meanwhile the Bank of England just held rates at 5.25%. Its mandarins are mostly confident this level should be enough to keep bringing inflation down:

Source: Bank of England

But who among us can live on good news alone?

Hard miles ahead

It’s worth noting that Bank officials are still saying rates might have to rise further.

Depending!

Besides, rates not rising doesn’t change the fact that they’ve already soared:

Source: Bank of England

Much of this dose of what’s good for us is yet to work through the economy.

For example, Labour cited research this week saying that another 630,000 homeowners will remortgage on to much higher rates between now and May alone.

The Financial Times has been running lots of stories about weak companies limping along on cheap debt that’s similarly due for refinancing.

And that’s not to mention entire shaky investment categories like private equity, which grew complacent and fat on nearly-free money.

With buyers for its portfolio companies drying up, some of those companies requiring more cash, and debt far more expensive than it was, private equity managers are having to get ‘creative’.

Which is a label in finance that typically only gets more specific when we discover how the wheels have come off.

Mapping out the future

Of course none of this is bad news, exactly, for central bankers.

In doing their calculations that rates are probably high enough, central bankers are presuming things will continue to slow down in housing and employment and with pay rises and the rest of it. And that this will continue to curb inflation.

It’s an obvious point, but enough punditry misses it to make it worth restating: you can’t look at the inflation chart above and say, “The Bank of England has done enough, inflation is already coming down, rates are too high!”

The forecasted fall in inflation is predicted on the current forecast for interest rates – which is that they will eventually go lower, but not next month and not back to zero.

Whereas if rates were to be cut prematurely because inflation is sliding, then the resultant pick-up in activity could arrest that slide, putting rate rises back on the table.

Along for the ride

For now though, the Bank of England seems to believe it has probably done enough.

Definitely maybe, as the world’s greatest pub rock band put it.

Similar narratives being told this week in central bank press conferences in the US and the Eurozone – plus some weakness at last in the hitherto unstoppable US jobs market – were enough to trigger heady gains for stocks and bonds.

So if you resolved not to look at your portfolio in the midst of the recent despond, be comforted it’s probably gone up a bit now.

Indeed a few more weeks like the last one and emotions could swing back to the fear of missing out.

Pretty hard to imagine from the vantage point of a fortnight ago, but markets are like that because people are like that.

Sitting out the guessing game and investing passively is much less stressful than riding this rollercoaster and trying to guess in advance its twists and turns.

For most people far more profitable, too.

When markets are down, just keep saving to take advantage of lower prices. When they rise, remember they’ll probably go down again, sooner or later.

Keep on keeping on.

We missed the last turn

Does that sound defeatist to you?

Well, recall that even central bankers were wrong-footed by the inflation shock – and looking out for that sort of thing is literally their day job!

Check out this graph of missed expectations from the Financial Times [Search result]:

Source: Financial Times

In sporting terms bankers whiffed it – the equivalent of sending a penalty kick high into the stands above the goal, or delivering a second serve into a ballboy.

And don’t think they have it easy now, either.

Raising rates to catch-up with suddenly-runaway inflation was a no-brainer.

Deciding when enough is enough is borderline guesswork.

From the same FT article:

Joseph Gagnon, a former senior staffer at the Fed who is now at the Peterson Institute for International Economics, says central banks are now at an ‘inflection point’ and that this is a point of minimum — rather than maximum — confidence in the outlook.

“When you know you’re behind the curve and you better raise rates fast to catch up, you have a lot of confidence that you’re doing the right thing,” he says.

“But then as you approach where you think you might have done enough, that’s when you’re less certain about the next move. That’s where they are.”

For market watchers this sort of thing is incredibly fascinating.

Not least because, as I wrote last week, asset prices will surge when investors are convinced inflation is beaten and rate rises are done.

As I say we got a taste of that with the strong rally of the past five days.

Finding our feet again

From a personal finance perspective though, whether the Bank of England keeps its Bank Rate at 5.25% or ultimately takes it to say 5.5% or even 6% is pretty irrelevant.

The journey has already taken us to a different reality. Arguably a saner one, but very different from where we began – one where you get interest on safer assets and there’s a real cost to borrowing money.

We’re nearly there yet, to answer the calls from the back.

But it will take us a while to get used to it.

Have a great weekend!

From Monevator

Low-cost index funds – Monevator

When growth goes wrong – Monevator [For Mogul members]

From the archive-ator: How scary can investing be? – Monevator

News

Note: Some links are Google search results – in PC/desktop view click through to read the article. Try privacy/incognito mode to avoid cookies. Consider subscribing to sites you visit a lot.

Bank of England holds Bank Rate at 5.25% – Investment Week

Early retirement in UK more the preserve of the wealthy, study shows… – Guardian

…as the number of over-65-olds still working soars – This Is Money

Private equity: higher rates start to pummel dealmakers [Search result] – FT

Workers in four-day week trial in Valencia less stressed, more social – Yahoo

London’s Square Mile to have 11 more towers by 2030 [Interactive pic] – Guardian

LinkedIn passes a billion members, launches AI chatbot – CNBC

China’s billionaires looking to move their cash, and themselves, out… – Guardian

…while Vanguard has just completed its own China exit – PI Online

Degrees don’t pay in the UK because our low-skills economy has too few graduate jobs – FT Via X

Products and services

Is there any point in a 4.85% fixed-rate savings account that lasts 30 days? – This Is Money

How to get £175 by switching to Barclays – Be Clever With Your Cash

UK mortgage borrowers can expect better rates, but higher fees – Guardian

Charles Stanley Direct’s new cash savings platform – This Is Money

Get £50 free trading credit when you open an account with Interactive Investor. Terms apply – Interactive Investor

How to invest in whiskey with just a few hundred pounds – This Is Money

Home insurers are denying too many claims – Which

Open an account with low-cost platform InvestEngine via our link and get up to £50 when you invest at least £100 (T&Cs apply. Capital at risk) – InvestEngine

How will leasehold reform affect existing homeowners? – This Is Money

Homes for sale in historic castles, in pictures – Guardian

Comment and opinion

Asset allocation isn’t magic – Oblivious Investor

Disciplined in the little things – Novel Investor

Six lessons from The Four Pillars of Investing – Humble Dollar

Emotions and market timing attempts are likely to cost you – The Financial Bodyguard

Look for financial big wins – The Art of Manliness

How and why you can join the army of digital nomads – Guardian

How do you walk away from good money? [Podcast] – Examined Life via Spotify

Inflation – Indeedably

My happy retirement – Humble Dollar

The Trussquake: one year later [Podcast, few weeks old] – A Long Time in Finance

Yet another bonds mini-special

Bonds look attractive again [Search result; rally since publication date] – FT

Why many don’t have the balls to buy bonds now – Behavioural Investment

A sea change for bonds? Really? – Humble Dollar

How to more than beat inflation, risk-free, with TIPS [US but interesting] – ETF.com

Naughty corner: Active antics

A long podcast interview with Charlie Munger [Podcast] – Acquired

Total shareholder return [PDF] – Morgan Stanley

11 things learned about investment… – Alchemy of Money

…and 12 predictions on the future of investing in music – The Honest Broker

An update on Tesla’s valuation in November 2023 – Musings on Markets

‘We’ve missed earnings forecasts lol’ [Search result] – FT

Kindle book bargains

I Will Teach You To Be Rich by Ramit Sethi – £0.99 on Kindle

Poor Charlie’s Almanack by Charles T. Munger – £0.99 on Kindle

The New, New Thing by Michael Lewis – £0.99 on Kindle

The Epic Rise and Fall of WeWork by Reeves Wiedeman – £0.99 on Kindle

Environmental factors

Boom in unusual jellyfish spotted in UK waters – BBC

Scientists start returning rescued Florida corals after heatwave – Axios

The Danish island aiming for zero waste – BBC

Robot overlord roundup

How AI chatbots like ChatGPT or Bard work [Visual explainer] – Guardian

Elon Musk sees a future where AI eliminates all jobs – CNN

Is Big Tech inflating AI risks to achieve regulatory lock-in? – Yahoo Finance

AI makes people more effective if they embrace it – Klement on Investing

Off our beat

Colonoscopy effectiveness: or how reading statistics is hard – Asterisk

What drives the racial wealth gap in America? – Of Dollars and Data

Britain’s housing crisis [Video series] – BBC iPlayer

Marvel has lost the plot – Variety

27 nuggets of wisdom from 300 hours of interviewing – Ryan Holiday

Moving to Arizona – Mr Money Mustache

Keep your phone out of your bedroom and read books instead – Emily Gorcenski [via A/R]

The good side of social media – Spilled Coffee

And finally…

“Spend each day trying to be a little wiser than you were when you woke up. Day by day, and at the end of the day – if you live long enough – like most people, you will get out of life what you deserve.”

Poor Charlie’s Almanack

Like these links? Subscribe to get them every Friday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Thanks for reading! Monevator is a spiffing blog about making, saving, and investing money. Please do sign-up to get our latest posts by email for free. Find us on Twitter and Facebook. Or peruse a few of our best articles.

Checkout latest world news below links :

World News || Latest News || U.S. News

The post Weekend reading: the end of the beginning for rate rises – Monevator appeared first on WorldNewsEra.